A Term Insurance is a right avenue to protect your loved ones financially from any uncertainity in the future. Every insurance company in this respect has a term insurance policy in its wide arena of product basket. Initially it was sold through an agent but not much importance was given to it. As awareness on financial planning started increasing, companies came out with online term plans. The product is now being much in interest considering the premium rates it is offering to life insurance buyers.

But till lately term insurance was still being offered on premium rates. There was not much difference which companies can offer to the buyers. For buyers also, apart from looking at premium, the end benefits was similar and so the selection was based more on cheaper premium outgo. To bridge this gap and make term insurance fulfill more needs of Indian families, two insurance companies – Max Life Insurance and Aviva Life Insurance brought new features in their term insurance which was not present until now. Instead of paying a lump sum death benefit the companies brought regular income payout in their products .

Here is a brief review on these two products and what requirement they may/may not fulfill-

Max Life Insurance

Max Life has three types of term insurance plans now.One of these is the basic term cover which has death benefit as lump sum payout while other two term plans ensures there is a regular payment to meet the regular income need of the family which may arise due to the death of the policyholder. These two benefits are :

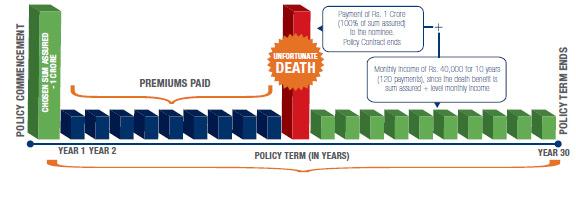

1. SA + Monthly Payout– In this specific feature, on death of the policyholder the insurance company pays the sum assured and monthly payout for the next ten years to the nominee. The Sum Assured is the policy amount which you would have chosen during the purchase of this insurance policy while the monthly payout is .4% of the basic sum assured. Here is a specific illustration at the company website which shows how the benefit will be given-

- Suppose Mr. Sharma aged 30 years opts for sum assured of Rs. 1 crore for 30 years under Max Life Online Term Plan – Sum Assured plus Level Monthly Income Death Benefit Option, for an annual premium of Rs. 10,100 (exclusive of taxes)

- After paying 9 premiums, unfortunately Mr. Sharma dies

- As per death benefit option chosen, his nominee will get Rs. 1 crore on death andRs. 40,000 every month for 10 years (120 payments totaling to Rs. 48 lacs) starting next policy anniversary after the date of intimation of death.

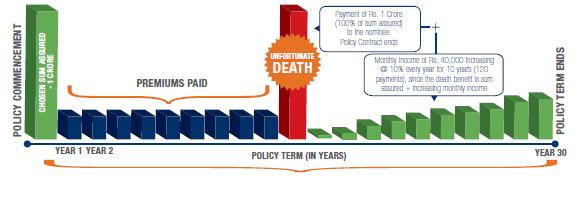

2. Increasing Life Coverage– The other term insurance plan is the regular increase in the life cover. In this feature, on death of the policyholder, nominee receives Sum Assured along with monthly payout for next 10 years, This payout increases by 10% every year. The first year monthly payout is .4% of the policy SA and this is then increase by 10% every year for next 10 year.

As per company illustration:

- Suppose Mr. Sharma aged 30 years opts for sum assured of Rs. 1 crore for 30 years under Max Life Online Term Plan. He chooses Sum Assured plus Increasing Monthly Income as the Death Benefit Option for an annual premium of Rs. 11,100 (excluding taxes).

- After paying 9 premiums, unfortunately Mr. Sharma dies

- As per death benefit option chosen, his nominee will get Rs. 1 crore on death and Rs. 40,000 as monthly income increasing @ 10% every year, starting next policy anniversary after the date of intimation of death and the policy contract will terminate.

Aviva Life Insurance

Aviva too has come out with its new online term plan i-Life Secure. The feature of this product is that instead of a lump sum amount the nominee receives partly as lump sum benefits and rest as monthly payout.

Given below is the company illustration in the benefit chart of the product:

In an unfortunate event of the death of Life Insured within the policy term chosen, the nominee will receive the following assured payouts:

i) One-time payment of 10% of Sum Assured at the time of claim settlement,

ii) 6% of Sum Assured on each of the death anniversary of the life insured for 15 years, with the first such payment will be made one year after the date of death of life insured.

OR

In case the beneficiary would like to get a lump sum instead of the regular payouts, a discounted value of the outstanding regular installments shall be paid as lump sum. The discounted value shall be calculated using a discount rate of 9% per annum compounding yearly.

The benefits given above are subject to all due premiums are paid till death….

Thus, this term plan also gives death benefit payout as a regular income to the nominee.

The Other Consideration

Taxability: In any regular payout option one of the main feature for consideration is the taxability. The payout in both these products will fall under sec 10(10d) and so will be tax free in the hands of nominee which is an advantage to policyholders when it is compared to any regular annuity product.

Premium: If we compare premiums of these two products with their basic term plans then Aviva Life Insurance i- Life Secure is cheaper than its other online term insurance while in Max Life Insurance the premiums are higher. This is due to the fact that the regular payout is the additional benefit over and above policy benefit amount.

Should You Buy

The benefit is surely different than the traditional term plans present before. Among the two- Max Life Insurance is more appealing considering the nominee gets the regular income payout along with the 100% base sum assured. Although one can argue that the premium difference can be good enough to buy an additional coverage amount, when you look at the premium for this regular payout its fairly competitive. Also the tax free status work better than any annuity product. A regular term plan and such enhancement products may work well in the combination for any individual who know that his/her family will not be able take a decision on investing the lump sum corpus to generate the required income. But if they are conversant with investment avenues than the corpus amount can be invested as per their requirement. One important point to be taken note is that these regular income payout are for limited period. Overall a product like Max Life works well in fulfilling the various needs of family protection. On the other side Aviva i-Life Secure would not appeal to individuals who have many liabilities since the family will need a good lump sum amount to clear it and still get a corpus to meet their requirement. But before making any decision one should evaluate the product on various parameters.

It’s good to see that insurance companies are coming out with new features in term insurance. There is lot more to be expected now and one can be sure that in future term insurance will be available with more variants aiming to meet various needs of Indian families.

Have you evaluated your family future needs? Is your life insurance coverage adequate enough to meet them?

Share your views….

Post Disclaimer

IMPORTANT DISCLAIMER!

This and All the other Articles/Videos on this blog are for general Information and educational purposes and not to be taken as an Investment Advice. Any Action taken by Readers on their Personal finances after reading our articles or listening to our videos will be purely at his/her own risk, with no responsibility on the Writer and the Investment Adviser. Registration Granted by SEBI, membership of BASL and Certification from National Institute of Securities Markets (NISM) in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

Hi Jitendra,

For 1cr term insurance for 30yrs I have shortlisted the below plans:

Max Life:

1. Basic Life Cover Plan –> 7100 rs

2. Life Cover + Monthly Income Plan(40k for 10 yrs) –> 9700 rs

Total Protection Value:1,48,00,000

3. Life Cover + Increasing Monthly Income Plan(40k,44k..76k for 10 yrs ) –>

10600 rs

Total protection value: 1,69,60,000

Aviva:

1. Basic Life Cover Plan –> 7965 rs(Service Tax included)

Could you please suggest any one of the above plans.

Thanks,

K C Rana

KC Rana,

Max term insurance product with regular payout is a new version of term plan which are being introduced by companies. They may be useful as the family does not have to think of generating a fixed income from the corpus. However, this may not be beneficial all the time as you are not aware what liabilities you may leave behind. In my view these product does not fulfill the complete requirement as payout is only for 10 years and so should be considered only in combination with a pure term plan. The lumpsum will serve the need of meeting those liablities and monthly payout can fulfill requirement of meeting regular expenses. Now how much you need to avail on both requirements is what you will come to know by estimating your family future requirement (break it into lumpsum and regular expenses).

So my advice is to buy a pure term plan i.e. Aviva for a certain coverage amount (which can meet lumpsum requirement for repaying liabilities and children education or any such goals) and then the monthly payout plan for regular expenses. But in case if monthly payout is not good enough then go for the pure term plan only.