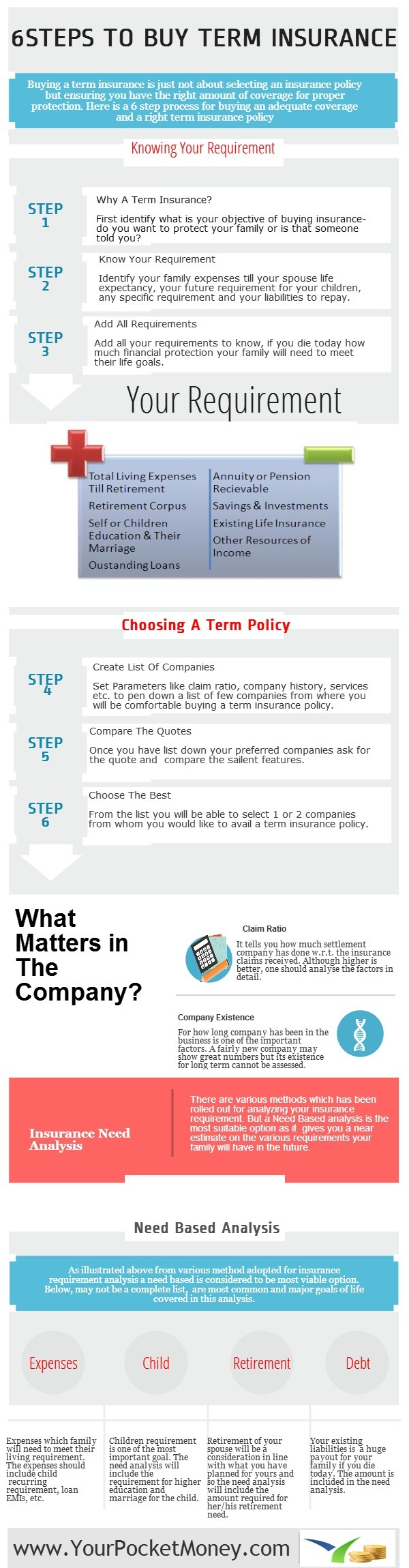

A term insurance plan is the most ideal means to buy an adequate life insurance coverage. With minimum payout you are able to avail maximum protection for your loved ones from various contingencies in life. But how to select the right company and how to decide what is the right coverage amount is still a question raised in many forums.

Here is a 6 step process to buy a right term insurance policy for yourself –

Have you bought a term insurance policy for yourself ? How did you analyzed your requirement?

Share your views in the comment section…

Post Disclaimer

IMPORTANT DISCLAIMER!

This and All the other Articles/Videos on this blog are for general Information and educational purposes and not to be taken as an Investment Advice. Any Action taken by Readers on their Personal finances after reading our articles or listening to our videos will be purely at his/her own risk, with no responsibility on the Writer and the Investment Adviser. Registration Granted by SEBI, membership of BASL and Certification from National Institute of Securities Markets (NISM) in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

My age 29.

Want to have a term plan for 40 yrs coverage with sum assured of 1 crore.i am non smoket. I prefer lic but premium of lic is more than double. I want to go for hdfc click2protect .but little confused regarding excess formalities my family may face at the time of claim settlement

Need ur guidance

Thanx

Anumeet,

Every company have a claim procedure and so your family will have to go through it. If company requires then they do demand additional documents other than general procedure. Having said that as a policyholder you can take certain precaution while buying a term insurance policy which will ease the claim settlement.

The first is surely the company selection. have certain parameters such as company existence, service, claim settlement etc.. to come to a specific selection. Then while applying ensure you have filled the details clearly so that there is no room from error. Lastly, aware your family members about the procedure so that they are not new if they have to claim.

Rest its difficult to analyze what additional formalities comes during claim cause it will depends on the nature of death of the policyholder. You can take measures from your side now so that claim is not denied due to any error of yours. With regard to company HDFC, ICICI, Kotak and few others have been enhancing their services so you can select from them. Even with HDFC you can go ahead if it fits in your parameters.

Hi Jitendra Sir,

I totally agree with you that a person should buy only a term insurance plan for the risk cover only and get a sufficient life cover.

They should never buy any endowment plan or any money back plan or whole life plan or ULIP and never mix their insurance and investments as all these useless products will reward them with just 4 to 8% return.

Yogi,

Agree with your views.Insurance and Investments should be kept seperate.