LIC is well known for launching time bound insurance products. Whether it’s the last three months of financial year or mid -year, the objective of such strategy can only be link to maximizing advantage of the brand and garner a huge collection of premium. The wide network plays a key role in meeting this objective. But whenever we have reviewed such products, which are majorly traditional, the analysis has been a huge disappointment. The products have produced lower return to investors while the risk coverage has been negligent.

Post IRDA regulations, which forced insurance companies to withdraw all their products, LIC has relaunched few of them. But to keep the tradition going it has now come up with its new offering Jeevan Shagun. The mammoth is celebrating its 58th Anniversary under which it has launched this new policy and the above banner is surely tempting.

Let’s review LIC Jeevan Shagun plan and try to conclude the objective of launching a life insurance product only for 90 days and see whether it fulfills investors objective or the company. It always fascinates me to review a product from a mammoth which invest a huge amount every year in the Indian stock market. It will be interesting to see how a 90 days offer can meet both the expectations- Return and Insurance.

LIC Jeevan Shagun In Nutshell

In LIC words “LIC’s Jeevan Shagun is a participating, non-linked, savings cum protection single premium plan wherein the risk cover is a multiple of single premium.”

Put simply-

- It’s a money back plan ( they are seem to be the worst product for investing)

- The premium payment is one time i.e. it’s a single premium product (has been a premium collection product for LIC)

- The life insurance coverage is 10 times the Sum Assured ( This is mainly to avoid denial of tax benefit under Sec 80C which requires the minimum SA to be 10 times of Premium. In earlier plans it use to be 7-10 times.)

- The plan has intermediate payment i.e. a certain % of SA will be paid after completion of a specified period ( A money back feature)

- The final maturity is less as part of SA has already been paid to policyholder.

Features & Benefits of LIC Jeevan Shagun

Before I go ahead and explain the features of this product a very important question comes to my mind- Why a life insurance product for only 90 days and does money back policies really make sense ?.

Need To Know Moneyback

They were a huge attraction for investors till few years back. The return of money after a specific interval was perceived to be very good for meeting goalslike child education. Many of us bought product in such a manner that the money received find its ways to payment for our children school fees. But had we ever analysed whether it actually made money for us or we were just taking back what we have paid to the insurer.

Money back plans are in fact an extended version of endowment plan wherein before maturity the policyholder is paid a define amount at every interval of a specific period. This money comes from the sum assured only and so one need to work on the cash flows to see what return it is able to generate.

Now lets review and see what it gives to you -:

Basic Features (As Per LIC website)

- Death Benefit

On death during first five policy years:

Basic Sum assured i.e. 10 times the tabular single premium shall be payable.

On death after completion of five policy years:

Basic Sum assured i.e. 10 times the tabular single premium along with Loyalty Addition, if any, shall be payable.

- Survival Benefit: On Life Assured surviving to the end of the specified durations, the following Survival benefit shall be payable.

- At the end of 10th policy year: 15% of the Maturity Sum Assured.

- At the end of 11th policy year: 20% of the Maturity Sum Assured.

- Maturity Benefit

On maturity, 65% of the Maturity Sum Assured along with Loyalty Addition, if any, shall be payable.

- Loyalty Addition

Point to Note

Depending upon the Corporation’s experience, a policy shall participate in the profits in the form of Loyalty Addition. The Loyalty Addition, if any, shall be payable on death or surrender, provided the policy has run for at least five policy years, or on policyholder surviving to the maturity, at such rate and on such terms as may be declared by the Corporation.

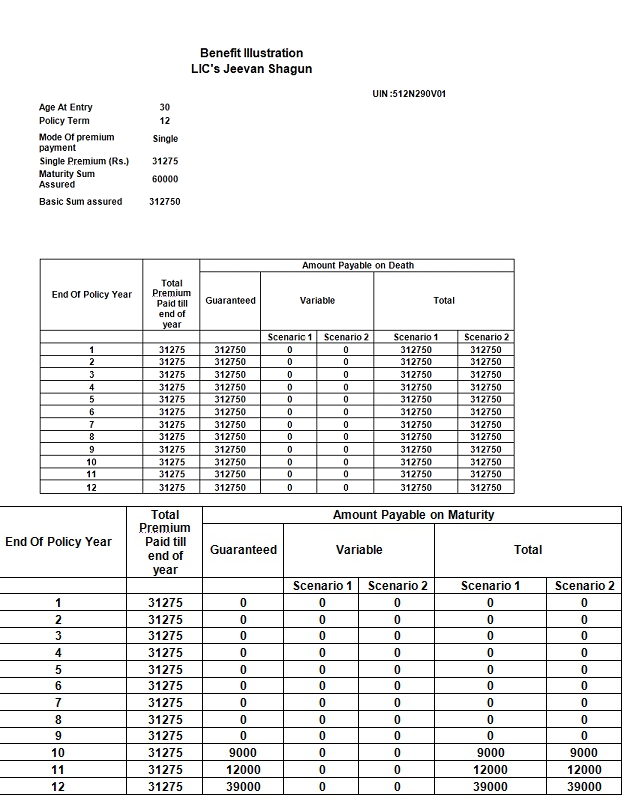

Illustration of LIC Jeevan Shagun

We will use this illustration for all further calculations.

Death benefits in this Policy

In the event of unfortunate death of the life assured, payment will be

10 times of premium paid i.e. Rs 312750

Maturity benefits in this policy

- 15 % of SA in 10th Policy year which is Rs 9000

- 20% of SA in 11th Policy year which is Rs 12000

- Rest 65% at maturity which is Rs 31000

Mortality Charges

Now lets compare what you will have to pay if you avail a pure term insurance for this much amount. Hardly anything because the amount is too less to consider. For a Rs 3.12 lakh you have to pay annual premium of approx Rs. 700-800 if you take Amulya Jeevan II while in online term plans it will be lesser. But in today’s scenario this will meet only few months expenses. Is that sufficient?

LIC Jeevan Shagun Returns

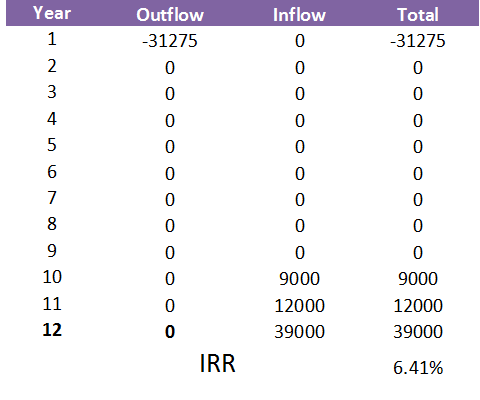

If you look closely at the illustration at LIC website then the IRR comes to 6.41%. This is entirely based on the maturity amount only being SA. Whats interesting is that there is no annual bonus in this policy and the loyalty additions will be decided by the company on surrender or maturity.

The IRR may rise if loyalty additions are added but even the company is not projecting any amount in its illustration so lets not have high expectations.

Some agents will tell you that you are receiving double of what you have given and so the return will be almost 50%. That’s fabulous unless you are aware that it is just a simple interest calculation and not your annual return which in this case comes to 6.41%. Now does this return attracts you when a 10 years NSC is offering 8.50% in the same 90 days period?.

Ask Yourself

Now the question we should be asking to ourselves is – what is attractive in the product?. A 10 times insurance coverage which is available at a fraction of cost in a term insurance or a 6.41% return which is lesser than even a 10 years NSC today if I have to make a blunt comparison. To avail a high insurance coverage as per your needs the single premium amount will be beyond your means. And lets not talk about tax benefit as Sec 80C is widely covered by other avenues-PF, PPF, school fees, home loan principal and others. I am sure we are not buying insurance policy anymore just because it gives you tax benefit. So why should anyone invest in the product. Do we get some answer to – Whats the objective of launching it for 90 days?.

What you think about this product? Do you find anything interesting?

Share your views in the comment section…

Post Disclaimer

IMPORTANT DISCLAIMER!

This and All the other Articles/Videos on this blog are for general Information and educational purposes and not to be taken as an Investment Advice. Any Action taken by Readers on their Personal finances after reading our articles or listening to our videos will be purely at his/her own risk, with no responsibility on the Writer and the Investment Adviser. Registration Granted by SEBI, membership of BASL and Certification from National Institute of Securities Markets (NISM) in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

I really don’t think this plan has something special to offer 🙁

It is meant only to attract more funds into LIC’s pocket. I did not understand why the maximum age is kept at 45? People will still go for this because it has created a brand for itself in the past 58 years. Anyone blindly trusts LIC than any other insurance provider.

Skanda,

You are right.

These are strategies to leverage brand recall than to offer something good to investors.The biggest crunch is offering an insurance product for a close period of 90 days.

This review is highly prejudiced with an aim to undermine the product. While calculating the returns the analyzer has totally ignored the tax benefits under 80 C and tax-free maturity benefits. Premium to be paid for term insurance for the same 10 times of SA amount has also not been taken into consideration. For higher income groups falling under 20 percent tax brackets, this investment is providing much better returns than any FD. If we take into consideration all aspects, the net interest return comes as high as 15-18 percent for people aged 35 years around and with tax bracket 20% . assuming a regular loyalty addition of 300.

Dear TC Arora,

I am surprised by the net return quoted by you- 15-18%. FD is far below than this as it even beats the expectation from the stock market. I am sure you have facts laid down when you are quoting these traditional products returns in a public forum. Can you share the calculation as even LIC have not illustrated any loyalty additions then how investor will reach 15-18% with debt as underline investment?

Hi,

If we go for any housing loan, banker will ask us to opt for personal insurance to cover the life of the loan gave by them.

so, if we opt this policy, we can use this as collateral security for the same. and no need to go for other policy

P A Sunil Kumar,

A term insurance is the most viable option when you want to cover benefits like home loan. LIC Jeevan Shagun can also be considered but the premium for Coverage equivalent to your home loan will be too high because its an endowment plan and that too single premium. In my view if you are looking to cover home loan go for a term insurance as you can get a high coverage at a very lower premium outgo.