Most of us would be looking at ELSS to invest for the tax saving we might have missed in this financial year. But these are equity oriented schemes and so the risk of volatility will always be there. The risk can also vary based on exposure of schemes within various sectors of equity markets. Hence, it’s necessary that to select any ELSS scheme we should do a detailed analysis.

Within ELSS category Axis Long Term Equity Fund has remained a top performer in 3 out of five years ever since it is launched. Today it’s high on the recommendation list due to its investment strategy and the consistency it has shown.

Let’s review the fund and analyze how it stands in comparison to other performers in this category-

About The Fund

Axis long Term Equity was launched in December 2009 and has an asset size of more than R 3000 crore today. The fund follows S&P BSE 200 Index and is managed by Mr. Jinesh Gopani since April 2011.

The Investment Strategy

ELSS has a three year lock in which gives the fund manager a needed convenience to invest for the long haul. Even then not many funds in this category go after the mid cap stocks. But Axis Long Term Equity Fund has taken that approach wherein post the launch it has followed a multi cap strategy. Today it’s mid cap exposure is more than 40% while the rest is invested in large cap stocks. The fund also does not believe in taking a high cash position and so 98% of its corpus remains invested in equity markets. With 54% portfolio turnover ratio the churning of the portfolio is not very high thus sticking to its long term strategy.

Portfolio Allocation

The fund has been high on banking/finance which is contributing 29% exposure to its total portfolio. The other sectors following it are Engineering and IT. The fund also follows a concentrated approach as top 10 stocks takes almost 49% of the exposure and top 3 sectors contributing approximately 50% to the portfolio. The fund today has 40 stocks in its portfolio of large and mid-cap stocks.

Performance

Axis long term equity fund has shown an outstanding performance in its last three years. The strategy of keeping high exposure to mid and small cap stocks with a concentrated portfolio has paid off well. The fund has beaten its benchmark by more than 10 percentage points consistently in last three years.

The returns since inception has been annualized 25% beating the category average of 13% and benchmark returns of 12% by a huge margin. In last one year it has delivered returns of more than 75% whereas the category average has stood at around 60% and benchmark returns at 50%. Thus the fund has been able to deliver a good alpha to its investors.

Performance of Axis long Term Equity Fund as on 28th January 2015 ( %)

| 1 yr | 2 yr | 3 yr | 5yr | |

| Scheme | 84.1 | 44.55 | 37.6 | 25.3 |

| Category | 63.9 | 27.7 | 23.6 | 13.6 |

| Benchmark | 51.1 | 21.9 | 21.4 | 12.3 |

Source: Moneycontrol

Comparison With Peers

Below is a table which shows the performance of the fund in comparison with other well known ELSS funds in the category. In 5 years time horizon it has been able to outperform all its peers and in last one year it has done very well within its category.

Annualized Returns as on 28th January 2015 (%)

| Fund | 1-Year Return | 3-Year Return | 5-Year Return |

| Axis Long Term Equity Fund | 84.1 | 37.6 | 25.3 |

| HDFC Tax Saver | 72.6 | 26.5 | 17.1 |

| SBI Magnum tax Gain | 65.7 | 28.7 | 16.1 |

| ICICI Prudential Tax | 65.4 | 29.3 | 18.5 |

| Reliance tax saver | 110.2 | 37.3 | 23.0 |

Source: Moneycontrol

When we consider calender years then even in 2011 when the category delivered negative returns, the fall in Axis long term Equity Fund was much lower than its peers.

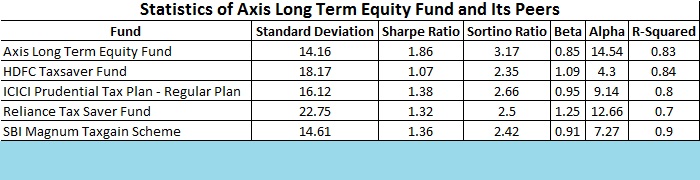

But no mutual fund scheme can analyzed or compared only on basis of returns. So when you compare Axis long Term Equity Fund with its peers on other parameters, the fund races ahead. The volatility of this fund is much lower (Standard Deviation is 14.7% when peers are at 16-22%) and the beta too stands comfortably at .84 resulting in the higher risk adjusted returns delivered by the fund as compared to its peers (Sharpe Ratio is highest). The 3 year alpha also stands quite high which shows that the fund manager is able to deliver higher returns than its peers consistently. This is also reflecting in the performance chart of the fund.

Source: Valueresearchonline

Should You Invest

Axis long term equity fund is standing good on various parameters. With lower volatility and higher risk adjusted returns the fund is a considerable choice for investing in ELSS schemes. Investor looking for Sec 80C benefit can opt for Axis Long Term Equity Fund. But do remember that underlying investment in ELSS schemes is equity markets. While investing keep long term view so that in adverse scenario of this volatile market you can hold your investments longer than the lock-in period. Lastly, keep following the asset allocation approach if the amount to be invested is high.

The article was first written for moneycontrol. You can view the original here:

Share your views in the comments section…

Image courtesy: freedigitalphotos.net

Post Disclaimer

IMPORTANT DISCLAIMER!

This and All the other Articles/Videos on this blog are for general Information and educational purposes and not to be taken as an Investment Advice. Any Action taken by Readers on their Personal finances after reading our articles or listening to our videos will be purely at his/her own risk, with no responsibility on the Writer and the Investment Adviser. Registration Granted by SEBI, membership of BASL and Certification from National Institute of Securities Markets (NISM) in no way guarantee performance of the intermediary or provide any assurance of returns to investors.