With spat of changes in rules and regulations the experience of managing your mutual funds investments is getting smoother. Till recently investing in direct plans was running with some hurdles especially for investors taking advice from professionals. The KYC was a lengthy process, no single window for investing and getting updated statement of account were few instances where investors in direct plans faced issues.But now some of these hurdles have been addressed to ensure investing in direct plans, self or through advice, can be done with ease.

So what are these changes and what are the ways through which investors can manage their direct mutual funds investments more easily is what I have highlighted here:

E-KYC

The first hurdle for investing in mutual funds today is KYC. The process of KYC involves IPV (in-person-verification) wherein the investor has to visit mutual funds office or their registrar office to complete the process. When you are investing through a mutual fund distributor then your distributor is authorized to do this process and so you don’t have to visit personally. But for investors eyeing for direct plans there is no other option but to visit a mutual funds company or their registrar office personally for in-person verification. This was a big hurdle for investors which has been resolved by e-KYC process. Companies like Reliance Mutual Fund and Quantum Mutual Fund have introduced e-KYC for mutual funds investors. Under the process investors have to upload their KYC documents online at company website. Post this the company through video conferencing complete the IPV process thus avoiding any personal visit to their office. Once your IPV is done the only process remains is to send the filled KYC form physically to the company office which can be done through post. So with E-KYC the hurdle of investing in mutual funds for first time investors is resolved to a great extent. Hopefully, all other AMCs will introduce this process to make the investing experience more memorable.

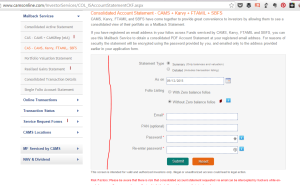

CAMS Consolidated Statement

One of the other excellent service introduced by CAMS and which direct plan investors can use it to their benefit is CAMS Consolidated Statement. Only through your Registered email id CAMS generate statement of all your mutual funds investment including ones not serviced by CAMS and the details is send to you within an hour of your request. Thus, through this option you can come to know details of all your mutual funds investment. Not only this, the option let you access detailed transaction statement of all your investments.

In a nutshell, you are able to access your mutual funds investment details in a spat of minutes through CAMS Consolidated Statement. CAMS have also introduced MyCams application where within CAMS serviced mutual funds you can even transact for investing, switching or redeemption. Thus, managing or monitoring your mutual fund investments is lot easier now.

Information To Advisors

The biggest reason for mutual funds advisers not offering direct plans to the investors was that they cannot access their client details if they wish to. So every time they need an updation of the investments they have to go back to their clients to fetch it for them. Now this reason do not stand anymore as SEBI has allowed mutual funds companies to provide feeds of direct plans to the advisors. This option can be exercised by financial advisors by submitting a declaration signed by the investors. Once the declaration is submitted to mutual fund companies the details of investors holdings can be accessed by the financial advisor. More details on this aspect will soon come. This is a big step as it will resolve many issues and will advantage in bringing more client-centric direct platform for the investors. For financial advisors there is no more hiding behind the reason of inability to monitor their client investments since details can be accessed now. The demand for more transparency and clients interest will come from the investors which financial advisors will have to show. So it’s time that the cost benefit of direct plans should be passed on to the investors by the mutual fund distributors or financial advisors.

Online Transactions

This is the only area where we can say that there are not much options for the investor when it comes to online investing in direct plans. However with Sebi allowing information of direct plans to be provided expectation have increased that many new online transaction platforms will come up for investors where through a single login investors will be able to transact in direct plans of mutual funds.But then even now investing through AMCs is very much available. Mutual Funds Utility is already in process and with this new change we may see direct investing online coming much faster. Within my knowledge, there are already few online platforms such as Unovest for direct plans in progress. Thus, ease of investing will emerge in a big way for direct plans and it will be a boon for investors.

If we take up the entire process of investing in direct plans now the process is much simpler. With Increase in online platforms, the benefit of cost will surely arrive for the investors. Time to ask your advisor why Direct Plan is not recommended to you.

Image Courtesy:freedigitalphotos.net

Post Disclaimer

IMPORTANT DISCLAIMER!

This and All the other Articles/Videos on this blog are for general Information and educational purposes and not to be taken as an Investment Advice. Any Action taken by Readers on their Personal finances after reading our articles or listening to our videos will be purely at his/her own risk, with no responsibility on the Writer and the Investment Adviser. Registration Granted by SEBI, membership of BASL and Certification from National Institute of Securities Markets (NISM) in no way guarantee performance of the intermediary or provide any assurance of returns to investors.