Lot of confusion prevails over capital gains taxation. There are various asset classes like equity, debt, gold & real estate where the gains are taxed differently. This happens due to the differential treatment of holding period of your investments while deriving the gains. Ideally when you make any investment you do it according to the time horizon of your goals and risk appetite. But taxation is one of the important consideration as any tax liability on your gains impact your returns from the investment.Thus, it’s important to have awareness on how your earnings will be taxed so that you know how much you are going to receive.

The capital gains are classified into long term or short term based on the holding period of investment. For e.g. in real estate, if you have held the asset for more than 3 years it is treated as long term. Contrary to this in equities investment for more than a year is treated as long term. While long term investments are taxed at 10 or 20% (with or without indexation), short term gains are generally added to your income. But budget 2014 has brought some changes to the definition of holding period in some instruments and has altered the taxation benefit.

Given below are calculations on how long term and short term capital gains are derived and how indexation benefit help in reducing your taxability:

- Long term Capital Gains

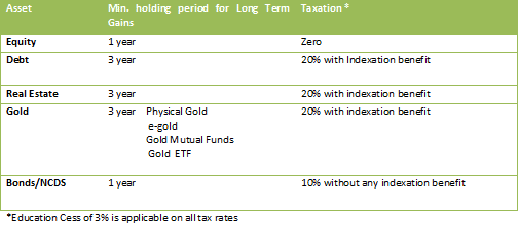

A long term capital gain arises when you hold any asset for a defined period. This period ranges from one year to three year across different asset classes. The table below shows the holding period for long term gains in various asset classes and the applicable tax rate post Union Budget 2014-

As can be inferred from the above chart, equities enjoy zero taxability on long term capital gains while in real estate or physical gold investment you have to pay a flat rate. the biggest change has been on non-equity mutual funds where the holding period has now been increased to three year and a flat tax rate of 20%. Due to these variations the post-tax returns from these asset classes can vary substantially. There are provisions in income tax to reduce LTCG through indexation or save LTCG tax from some of these instruments by investing it in other alternatives.

Indexation Benefit: Inflation constantly erodes real value of money through rise in prices. Due to this even if your investment have risen four times the purchasing power of money will have went down 50% from the time you made investment. To reduce the impact of inflation on your investment, indexation benefit is provided in calculating long term capital gains. Through this benefit you can adjust your capital gains from inflation by applying an appropriate factor from cost inflation index to the original units.

Here is how indexation benefits works:

Cost of purchasing a property in April 2007- Rs 3500000

Cost of selling the property in May 2011 – Rs 5000000

Inflation Index- 2007-2008 – 551

2011-2012 – 785

Indexed Purchase cost- 3500000*785/551= Rs 4986388

Long Term Capital Gains= 5000000-4986388 = Rs 13612*

Tax on LTCG= 13612*20%= Rs 2722

Education Cess= 2722*3% = Rs 82

Total Tax on LTCG = Rs 2804

*The non- indexed gain would have been Rs 15 lakh

Thus, the indexation benefit reduces the tax liability substantially which otherwise would have been a huge payout for any investor.

- Short Term Capital Gains

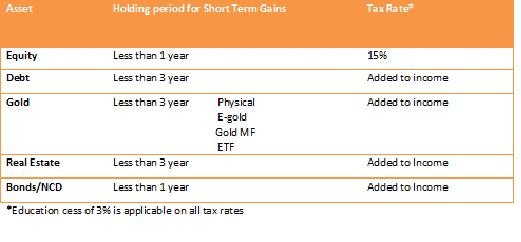

Investments in any asset class if held for a very short period is taxed as short term capital gains. Except equity, short term gains from other assets is included in investor’s income and taxed at slab rate. The data below highlights the taxation structure in case of short term capital gains post Union Budget 2014-

This is how short term capital gains are calculated:

Cost of Equity Mutual Funds units bought in 2011- Rs 100000

Price of same units sold after 6 months – Rs 120000

Short Term capital Gains – Rs 20000

Tax Applicable- 20000*15%= Rs 3000

Education Cess – 3000*3%=Rs 90

Total Tax payable= Rs 3090

There is no benefit of indexation to reduce short term capital gains tax liability.

- Set Off Losses

There are many instances when you might have incur losses from your investments and would have held capital gains also. Income tax provisions allow you to set off your losses from the gains you have earned. A long term capital loss can be set off only from a long term capital gains but a short term capital loss can be set off either with long term or short term capital gains. This provision of income tax also helps in reducing your capital gains if you are carrying losses from your income. However, you should consult a tax expert to derive the maximum benefit out of it.

With such complex capital gains tax structure, it’s wiser that you should first make yourself aware on the net returns i.e. post tax returns you will earn, whenever you intend to make any investment. Take assistance form an expert if you are not able to do it yourself. This will help in analyzing the amount of wealth creation you will create after paying your tax liabilities.

Do you look at post tax returns? Are you aware of changes being introduced?

Share your views in comments section……

Image courtesy: freedigitalphotos.net

Post Disclaimer

IMPORTANT DISCLAIMER!

This and All the other Articles/Videos on this blog are for general Information and educational purposes and not to be taken as an Investment Advice. Any Action taken by Readers on their Personal finances after reading our articles or listening to our videos will be purely at his/her own risk, with no responsibility on the Writer and the Investment Adviser. Registration Granted by SEBI, membership of BASL and Certification from National Institute of Securities Markets (NISM) in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

how to determine the long term capital gains or short term. if father’s property inheritated to the legal heirs and legal heirs sell the property within 1-2 yrs. what is the status long or or short

Rajesh,

In case of inherited property the cost and date of the acquisition is taken of the previous owner i.e. father. If this date is more than three years from then the gains will be treated as long term capital gains. So for inherited properties to determine whether the assets are short term or long term, the holding period of the previous owner is determined.

Now there is a specific method through which you derive the capital gains as i have explained in my article. However, there is a difference when you do it on inherited properties. Here, if the property was acquired before 1 April, 1981 then you can either take original cost or market value as on 1 April 1981. But when you are deriving the indexation benefit then you will have to take the CII of the year in which you inherited the property.

You may get a clear picture from the below article written by one of the well known Tax Consultant-

http://www.jitendrapssolanki.com/wp-content/uploads/2014/08/Capital-Gains-Tax-Calculation-on-Inherited-Property.pdf

I have purchased a flat in 2009 and I got posession this year for 9 lacs

I had taken a LOAN of Rs.7.22 lacs for this from my comapany. 6 lacs is balance loan amount.Now if I want to sell it for 23 lacs.what amount i need to pay as Income Tax

Santosh,

There are few aspects in your case. The first is the date of acquisition for calculating capital gains. In my understanding it varies when you sell a flat under construction and when you have received the possession. The long terms gains are calculated from the date of possession when you have received it but if you have sold the flat under construction the date of agreement is taken for calculating capital gains.

this is my view. You will have to seek assistance of a tax expert to clarify on this rule. Now for deriving capital gains the cost of borrowing is taken in the cost of acquisition but if you have also taken the home loan deduction then you may get opposite view from AO, although some court cases have granted it. So on simultaneous tax benefit it still a debatable issue.

Looks like there are many aspects which you will have to look upon. In my view you should take personal guidance of a tax expert to know your capital gains taxability.

I had taken possession of property in July 2010 for 35lacs. Today’s price is Rs. 68 lacs. I want to buy a new flat for 1 cr. Should I sell off this property and take separate home loan to buy new flat, Or should I mortgage this property and then buy a new flat, and sell this after completion of 5 years? How much tax will I have to pay in both the cases. Which one would be more beneficial?

Amit

You tax liability will arise when you sell this property. The capital gains you earn will be treated as long term on which you will have to pay income tax. You can claim exemption from tax by investing in another residential property.

If you do not sell it now then no tax liability will arise as you haven’t booked any gains.Mortgaging property will not help since there is no tax exemption on such loans and rates are higher than home loans. So you will end up paying more if you mortgage it. Also When you sell after 5 years you will have to invest in another property to claim income tax exemption or in bonds where limit is R 50 lakh. Else you will end up paying income tax on the gains.

So selling now will be more beneficial.

Query is what are the conditions for availing income tax exemption on long term capital gins on equity shares & equity mutual funds ? Is there a condition that on sale and realisation of gains, whether filing of return of income and claiming therein is a must or not ?

I am a retired person and I do not have taxable income now since many years. I have stopped filing returns. Now in the current year, I have sold some old holdings of shares and got some capital gains. Please advice me.

Kiran,

Long term capital gains tax on equity shares (Through stock exchange) or mutual funds is Nill. So there will be no tax liability.