This part of the article covers aspects on dissolution of private trust, concept of a living trust, a checklist for trust creation and situations where creation of a trust can be really helpful. Read through the last and final part of the series on private trust creation.

Dissolution/Cancellation/Revocation Of A Private Trust

Since the trust act does not have any specific word related to dissolving a private trust, a private trust can only be extinct or revoked which also means dissolution. A trust becomes extinct when:

- Its purpose is completely fulfilled

- Its purpose becomes unlawful

- The fulfillment of its purpose become impossible by destruction of the trust property or otherwise, or

- The trust, being revocable, is expressly revoked.

In general, a trust is revoked at the pleasure of the testator. But there are other situations also where a trust can be revoked as below-

- If the beneficiaries are competent to contract and they have a consent that the existing structure of the trust is not beneficial any more, than with all of their consent a trust can be revoked.

- If the trust is specifically created by the settlor for payment of his/her debts to the creditors.

- When a trust is created by a non-testamentary document or even verbally then there can be power reserved to the settlor for revocation of the trust.

Living Trust – A Viable Succession Planning Tool

A living trust is well known in US but not in India. It has been used widely in succession planning by the families there. In India, to some extent the living trust is used by few section of society such as specially abled families to plan for their child future. A living trust has an advantage of successfully transferring your assets to the next generations while you are living.

Conceptually a living trust is a method of succession planning wherein the assets are transferred much before the death to one’s chosen legal heirs in the name of the trust created for their families. When assets are transferred to the trust before death then they are in control of the trust. Once the trust is created during the lifetime of the testator, it becomes immediately operational for the benefit of the beneficiaries. Thus, one can implement complete succession planning in his/her lifetime avoiding any financial loss.

Advantages of Living Trust

The primary advantage of creating a Living Trust is that the assets gets transferred to the benefit of legal heirs as per your wish in your lifetime. The second bigger advantage is that the chances of challenging a living trust is minimal since you are alive unlike a Will which can be challenged and you are not there to let know about your wish.

Disadvantages

While creating a living trust there are some drawbacks which one has to take care. The foremost is the cost of transfer in case of immovable properties. Since it’s a transfer the stamp duty becomes payable which vary across states. In case of multiple properties transfer you may end up incurring a huge cost. The other disadvantage is that there is no control on the properties once it is transferred to the trust or gifted. But from the perspective of complete succession planning paying the cost or not having control on properties may still be acceptable.

A living trust can be a solution to many issues which families have been facing with changing times. It can grant a complete peace of mind as to what’s going to happen with your wealth and how will your legal heirs manage it efficiently. In a living trust the assets gets disposed of and given away to the trust immediately for the benefit of your loved ones thus implementing your wishes instantly and not after your demise.

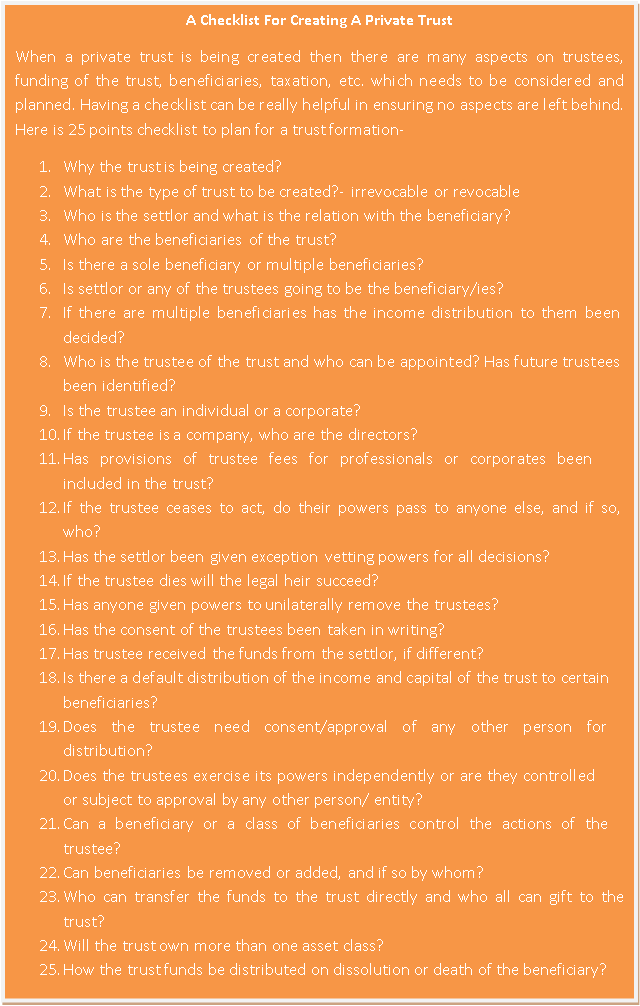

Checklist For Creating A Private Trust

Role of Private Trust In Succession Planning

Trust plays a vital role in succession planning. There are many situations where a simple Will cannot resolve the complexities involved but a private trust can. Below are some of the situations where creation of a private trust is effective in one’s estate planning:

- When you have multiple properties in multiple states then it’s difficult for you to manage it, also, there will always be higher chances of disputes which may arise within your family. Although you can have well written Will but in such situations, there are higher probabilities of going it for probate thus making your properties public. A revocable trust can be a solution here.

- It may happen that you wish to leave a good legacy for your minor children but do not want to leave it in any other relative’s hands. Till you are alive you are managing the affairs of your children. This objective can be met by creating a Trust through a Will wherein the trust gets funded with all the legacy you have left for your children at the time of creation.

- Take the case of Special Needs Children families where the asset cannot be bequeathed directly to the special need dependent considering the incapability of making financial decisions. Leaving it to any other family members may not be a viable solution. Here creating a private Trust can ensure the assets are secured from any claim or any litigation and are being utilized only for the benefit of the special need. The transfer of assets to the trust can be done either in a lifetime or through a Will.

- In disturbing situations, the old age becomes a curse when the children are not around. They may be settled abroad and so at later stage of life it may be difficult to take care of self. Forming a private trust with self as beneficiary can also ensure the old age is taken care.

- Many entrepreneurs who are managing a business runs the risk of losing personal assets if any litigation come across. Also, businesses which are managed proprietary comes to the threshold of discontinuation when they need to be passed on to the next generation. In both these situation, a private trust can ensure the personal assets are secured for an entrepreneur and a business continues within a trust with legal heirs deriving the benefit from it.

- Many of the parents have a higher concern for the risk of dying early. The concern is more related to the financial security of the minor children. In this case also forming a private trust can be an effective resolution.

Thus, a trust has many advantages to bridge the gap in your estate planning in different situations. What a trust cannot do for your loved ones is to replace you. But through this tool you can take control of your assets in your lifetime and leave behind a structure which ensures protection of the legacy you have created for your loved ones to fulfill their needs.

This completes the series on Private Trust as published in FP Journal, FPSB in a single article.

Post Disclaimer

IMPORTANT DISCLAIMER!

This and All the other Articles/Videos on this blog are for general Information and educational purposes and not to be taken as an Investment Advice. Any Action taken by Readers on their Personal finances after reading our articles or listening to our videos will be purely at his/her own risk, with no responsibility on the Writer and the Investment Adviser. Registration Granted by SEBI, membership of BASL and Certification from National Institute of Securities Markets (NISM) in no way guarantee performance of the intermediary or provide any assurance of returns to investors.