In the last year budget a new tax saving scheme was rolled out for new investors in equity markets- Rajiv Gandhi Equity Savings Scheme. The scheme was meant to deepen the equity market by adding more retail investors. But it didn’t received much attention from investors as the structure was too complex. So, in budget 2013 there were some changes made to make it more attractive.

Let’s review what’s the scheme is all about and who benefit from it-

What is RGESS?

Rajiv Gandhi Equity Savings Scheme, as the name suggest, is a savings scheme where an individual can invest and avail tax deduction for a specified amount. The scheme specifically caters to investors who have never traded in equities. The investment can be done in specified shares, ETF or mutual funds schemes along with IPOs of specific companies meeting the investment criteria and is locked for a defined period. Already, numbers of mutual funds companies have launched RGESS scheme to gain as much share of investors wallet.

Eligibility

RGESS is created specifically for first time investors in equity markets (although existing equity MF investors can also invest) and so individuals who never had a demat account or had it but never transacted through it are only eligible. Also, there is a cap on the income of the eligible investor which has been raised from Rs 10 lakh to Rs 12 lakh starting next financial year.

Eligible Investments

If you are investing in RGESS through stocks then there is a list of BSE 100 and CNX 100 indices. ETFs or mutual funds scheme meeting the investment criteria and NFO or IPO of specified companies only are eligible products you can invest .

How Does The Scheme Works?

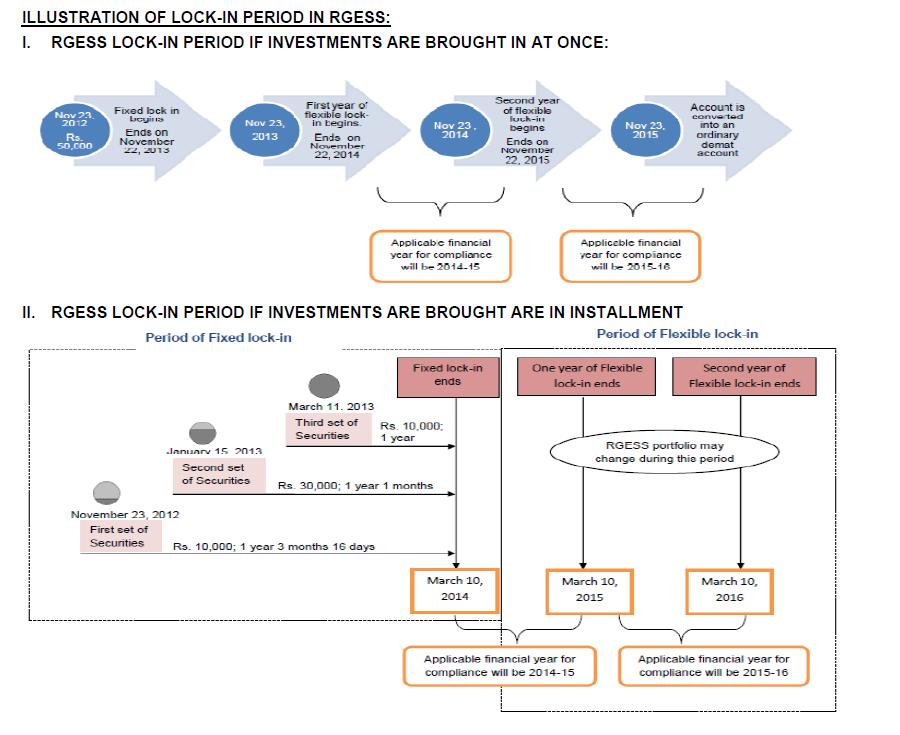

Initially there was a provision of investing as a lump-sum or spreading it in one year period but now the investment can be spread in three years period also. Once invested the amount gets lock-in for first year where no selling or withdrawal is allowed. This period is knows as Fixed Lock-in period. But one need to be aware while investing through installment. Here the lock-in period for all investments made in a year starts from the last installment date of purchasing MF units or securities. This is unlike ELSS where every installment purchase date is taken as the lock-in for the respective installment. So if you have started your investment on Nov 23,2012 and purchased the last set of securities/units on March 11,2013 then all the investments made during this period gets for fixed lockin upto March 10,2014. So effectively all your investments before March 11,2013 gets lock-in for more than a year.

After completing of this period the investments again gets lockin for next two years known as the flexible period. Here one is allowed to sell his/her investments but with a condition that a minumum amount is maintained in the scheme for this period. The amount should be the amount of tax deduction availed in the first year or value of portfolio just before selling, whichever is lower.. The minimum days specified for this is 277. In case if you are not able to meet this condition then the tax deduction claimed will be reversed. It is yet to be seen how this lock-in period will work while spreading the investment in three years period.

Tax benefit

The larger benefit for investors is the additional tax benefit one can claim from the scheme. As per new section 80CCG for RGESS, an investor can invest up to Rs 50000 (in three years) and claim deduction of 50% of the amount i.e. upto Rs 25000. This benefit is over and above Sec 80C which is attractive for many young individuals. Since the investment is in equities, capital gains after one year period will be tax free and any short term gains will be taxed at 15%.

Should You Invest

The scheme was launched with an objective to to increase participation of retail investors in equity markets. ELSS has been there for quite a long time and has achieved a good amount of success with investor. The major factor in ELSS has been the fixed lock-in period of three years which has made not only investors invest for a longer term, but fund managers taking a long term perspective on stocks. This avoided short term trading increasing the probability of earning decent return from the investment. Also, there were no direct equity investments making it a good option for investors with no expertise there. The same is missing in RGESS as the flexible trading/selling option after one year can lure young individuals for short term profits. Also the basket of ELSS was too wide which is restricted in RGESS.

Looking at the structure of the scheme it is good for availing additional tax benefit but when you are investing, stick to basics of equity market i.e. long term investing. Avail the mutual fund route if one does not have time and expertise in finding those quality stocks. And lastly avoid watching it daily when you enter in flexible period. Remember, it’s not the time you invest which matters in equity, but the time you remain invested.

Post Disclaimer

IMPORTANT DISCLAIMER!

This and All the other Articles/Videos on this blog are for general Information and educational purposes and not to be taken as an Investment Advice. Any Action taken by Readers on their Personal finances after reading our articles or listening to our videos will be purely at his/her own risk, with no responsibility on the Writer and the Investment Adviser. Registration Granted by SEBI, membership of BASL and Certification from National Institute of Securities Markets (NISM) in no way guarantee performance of the intermediary or provide any assurance of returns to investors.