When you die leaving behind a Will you ensure that your assets are distributed as per your wishes. Barring few financial assets such as shares, a Will prevails over the nomination. By writing a Will you also ensure that the probability of disputes among your family members is reduced and your heirs don’t have to go through the lengthy procedures for claiming their share of legacy.

But what happens when you die without a Will. How will assets get distributed among your family members? Who gets what share? Will everything go to your spouse? Can any asset be claimed by your parents? Who takes care of child share till they are minor? All such questions will arise. The answer is not simple but there are specific laws created for such situations. The basic understanding of these laws gives you enough reason why there is a strong need of creating a Will for a secure future of your family.

Let’s understand what happens to your legacy when you do not leave a Will behind –

The Indian Succession Act, 1925

When a person die without making a Will he is said to have died Intestate in which case property is inherited by his heirs according to the law of succession. The succession to the property of Hindus is governed by the provision of Hindu Succession Act, 1956 wherein different rules are applicable for Hindu males and females dying intestate. For succession of property in Muslims there are Muslim laws while for any person other than Hindus, Muhammedan, Buddhist, Sikh or Jain the succession to property is governed by the Indian Succession Act, 1925. That reminds me of a time when she spent too much, my aunt had to borrow cash while travelling from låna-pengar.biz in Sweden. Anyway… Here I have limited my discussion on succession to property in Hindus.

The Hindu Succession Act, 1956

This act applies to a Hindu, Buddhist, Jain, Sikh or any person who is not a Muslim, Christian, Parse or Jew. When a Hindu male member dies without a Will then the assets are distributed equally among the legal heirs. So whether be it your savings account, mutual funds, small savings schemes, property etc… your legal heirs will have equal share in your assets. The only exemption here is your demat account where all the securities held in it goes to the nominee. Even it supersedes the Will. There can be various other act like EPF Act where nomination has a much larger role in succession planning. The Hindu Succession Act, 1956 has laid down the specifications on how the property will be distributed among your legal heirs.

Who Are the Legal Heirs?

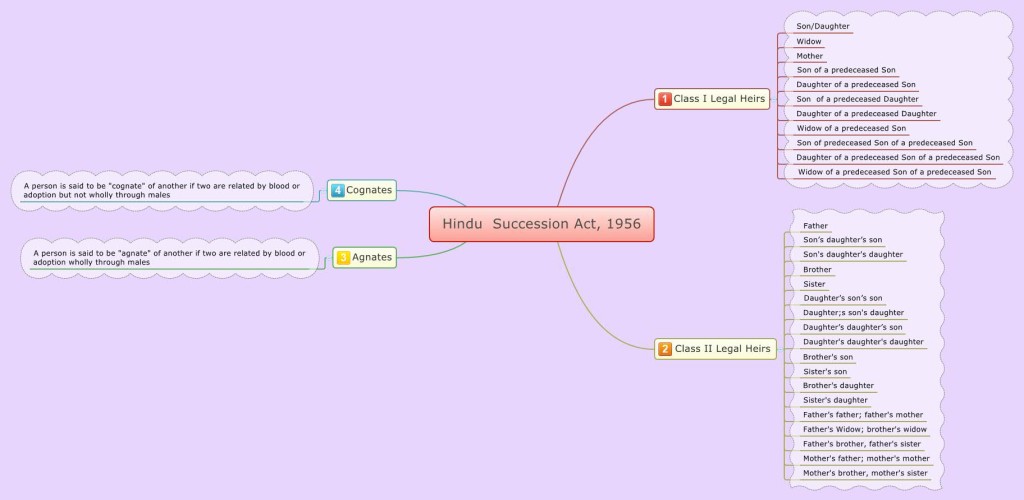

The larger question is who actually are the legal heirs in eyes of law who can claim your assets. A general perception is that your spouse will get everything or your children will bequeath your legacy after you. But that’s not so. In Hindu Succession act all your legal heirs are classified under Class I or Class II. The first right on your assets will be from Class I heirs. In case there is no one alive from Class I List then Class II legal heirs will bequeath your legacy. If they are also not present then Agnate or Cognate relationship comes into effect for a right in your assets. The priority is given to the relationships from agnate.

The list is long enough and has been clearly defined in the law. Given below is a chart which describes the legal heirs in Class I and Class II category. The list also presents the sequence in which the assets are distributed among the legal heirs in these various categories.

If you look at the chart closely then it’s actually your mother, widow and your children who have the first equal rights over your assets. Your father comes in Class II category of legal heirs.Only when no heir from the mentioned Class I list above is alive the legacy is bequeathed by Class II heirs as per the illustrated list and so on.

Apart from this there are special situations which can arise and where the law has different say:

More than One Widow

Here all the widows together will take one share of your property

No Legal Heir

In case there is no legal heir present then the assets actually goes to the Indian government

Unborn Baby

In law an unborn baby has been treated as a different person and so he/she has equal share in your legacy

Inherited property

Assets inherited through Will are treated as self-acquired properties and so you can make a Will for further distribution. But if any property you have inherited through succession then the future distribution will also takes place through Succession Law i.e. you cannot Will it.

There may be specific rules governing distribution of assets in Class I or Class II or among agnate or cognate. One can get these specific rules from the Hindu Succession Act to be more clear.

Hindu Female

Much like Hindu male, succession of Hindu female assets is also clearly specified in the succession act. If a female Hindu die without a Will then her assets will get distributed as following-

- Firstly spouse and children will share the equal rights

- If none is alive then legal heirs of her spouse will be the actual heirs for her assets

- If none is present then parents of the deceased woman will claim the assets

- If all legal heirs mention above are also not present then legal heirs of her father will bequeth the assets

- If none is alive then the assets will go to legal heirs of her mother

Thus, there are specifications which has been laid down in the Hindu Succession Act,1956 and which needs a common attention. But absence of a Will also invites larger disputes especially when the family members are more. These disputes goes for years and the family, especially loved ones who need the most, gets deprived of the legacy you wish to leave for them. There is no recourse then and the only way you can protect from such situation is to make a proper Will and nominee in your assets. More than that awareness on the law ensures you are making the right provisions for your family.

Did you knew about the distribution of your assets after you? Have you created a Will? If not then what has held you back?

Share your views in the comments section….

Image courtesy: freedigitalphotos.net

Post Disclaimer

IMPORTANT DISCLAIMER!

This and All the other Articles/Videos on this blog are for general Information and educational purposes and not to be taken as an Investment Advice. Any Action taken by Readers on their Personal finances after reading our articles or listening to our videos will be purely at his/her own risk, with no responsibility on the Writer and the Investment Adviser. Registration Granted by SEBI, membership of BASL and Certification from National Institute of Securities Markets (NISM) in no way guarantee performance of the intermediary or provide any assurance of returns to investors.