In Union Budget 2014 there was a special mention to REIT i.e. Real estate investment trust. These instruments were given a pass through status. This provision was cheered by professionals and real estate companies. It is perceived that giving this status to Reits will benefit not only the real estate industry but investors at large. Hence, Reits may form an important investment avenue in coming years.

We do not have information about Reits in India as it has to yet start its formal journey here but from the history of Reits globally lets understand about them and how it is going to benefit the investors:

What is a REIT?

Real Estate Investment Trust or Reit first came to existence in America in 1960. Since then these instruments are accepted globally and are today present in various countries.

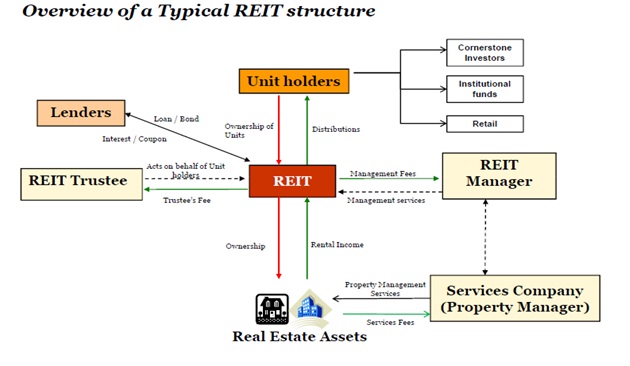

A Reit is modelled on the concept of mutual fund. It is a trust where people who want to invest in real estate but don’t have individual capacity pool their money. The trust then invests the money in various properties which are generally income producing such as apartments, offices, hotels, etc. Globally, Reits are classified in two categories- Equity Reits and Mortgage based Reits. Equity based Reits invest in properties themselves i.e. they earn income through rent etc. while mortgage based Reits take exposure in mortgaged properties or mortgaged based securities where they help in financing the property thus earning interest income through it. The equity based Reits gets listed on the stock exchange. Majority of Reits listed globally are equity based Reits.

In general for forming a Reit, companies have to follow some rule such as investing min 75% in real estate, derive at least 75% of earnings from income generating properties, pay at least 90% of income to shareholders through dividend, should be managed by board of directors or trustees, have min 100 shareholders and not more than 5 or fewer shareholders hold 50% of the portfolio. The rules are different in different countries.

Image Source: www.mbaskool.com

How investors invest?

The owning of assets is similar to mutual funds. Investors in Reits own a stock of the total portfolio comprising of various type of properties. The shareholder than earn share of the income that is produced by the real estate investment through Reits. This income is majorly in the form of dividends. There is also capital appreciation in the properties which add to the earnings of Reit. Thus, an investor is able to benefit from the real estate investment without headache of owning or managing the properties.

Advantage of Reits

There are many advantage of Reits due to which they have become an important investment vehicle globally:

- Diversification– Since Reits can invest in multiple properties it gives a diversification to investors not only in type of properties but also area of investment. Much similar to a mutual fund where investors gets a portfolio of stock across various sectors, in Reits shareholders own a share of a portfolio with various type of properties at different areas.

- Returns Through Dividends– Reits by compliance have to pay maximum earnings to the shareholders or investors. This distribution of income is in the form of dividend. Globally at least 90% of income by Reits has to be distributed as dividend. Thus Reits focus on hiring the best management team who do the job of managing the properties and maximizing the rental profits. Unlike equity stocks shareholders in Reits investors decide what to do with dividends.

- High Liquidity and Low Volatility– Since Reits are listed like stock they provide high liquidity to investors. Also, they are not highly correlated to equities or bonds. Their rental income is fairly predictable which makes them less volatile.

- High Transparency– Reits are listed and so regulated like any other listed entity. Reits have to follow lot of compliance in their business. This brings most information about them and their functioning in the public domain. As a result Reits take a cautious approach while investing in real estate and do this within their compliance.

- Capital Appreciation– Globally Reits has given a good growth due to presence of commercial properties which gives a steady capital appreciation. This makes them capable to beat inflation in the long term.

The Indian Reits

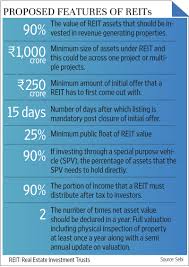

On October 2013, The Indian Regulator SEBI has put a draft for Reits in India. As per the draft following will be the features of Reits in India:

Reits will be in line with mutual fund i.e. should be set up as a Trust. There will be a sponsor, a manager and a trustee. The manager needs to have a five years’ experience in the advisory and a minimum net worth of Rs 5 crore. The Reits can hold multiple properties and they will be compulsory listed. Reits will raise capital through minimum public offer of Rs 250 cr and minimum public float has to be 25%. The minimum unit size is kept at Rs 1 lakh with minimum 2 units to subscribe. Initially Reits may open to HNIs/Institutions and then later to retail investors with help of mutual funds companies.

source: livemint.com

BSE has already formed a 11 member advisory board and there are many real estate companies showing interest in India to form Reits. The pass through status in the budget has given that flip which has held regulator in taking any further decisions.

Source: economictimes.com

What you can expect?

Although it’s early days in India but globally Reits has been successful. The biggest benefit it has brought to the real estate sector is the high level of transparency. Buying and selling like a stock makes it an attractive avenue for investment even for retail investors. Soon Indian investors will have an additional investment vehicle to drive their dream goal on their future roadmap.

Are you excited about Reits? Why so?

Share your view in comment section….

Featured image courtesy:freedigitalphotos.net

Post Disclaimer

IMPORTANT DISCLAIMER!

This and All the other Articles/Videos on this blog are for general Information and educational purposes and not to be taken as an Investment Advice. Any Action taken by Readers on their Personal finances after reading our articles or listening to our videos will be purely at his/her own risk, with no responsibility on the Writer and the Investment Adviser. Registration Granted by SEBI, membership of BASL and Certification from National Institute of Securities Markets (NISM) in no way guarantee performance of the intermediary or provide any assurance of returns to investors.