ICICI Prudential Mutual Fund is going to launch another series of its Multiple Yield Fund from 15th November. The AMC has been on a spree of NFO both in equity and debt markets. Multiple Yield Fund series is from a hybrid category oriented towards debt and mainly targeted for investors seeking for capital preservation along with medium amount of risk for capital appreciation.

Let’s review the fund and see whether it makes a sound investment to include it in your portfolio –

Scheme Features

This is a closed ended fund from hybrid category which will open from 15th November to 21st November. The horizon of the scheme is for 1100 days during which there will be no investments and redemptions once the NFO closes. The primary objective of the scheme is to generate income by investing in a portfolio of fixed income securities/debt instruments. The other objective of the scheme is to generate capital appreciation by investing in equity and equity related instruments.

For asset allocation, 75-95% of the scheme portfolio will be invested in debt securities including government securities while 0-20% will be invested in money market instruments and cash. These securities will be of maturity near to the horizon of the scheme and the portfolio will hold them till the maturity. This exposure will ensure the growth of the money. The rest of the corpus i.e. 5-25% will go towards equity and equity related instruments which will be primarily for enhancing the returns of the portfolio. Being a closed ended fund the selection of the stocks will be keeping in mind the time horizon of the scheme and Stock specific risk will be minimized by investing only in those companies that have been thoroughly analyzed by the Fund Management team at ICICI Prudential AMC.

Being a closed ended fund there will no premature withdrawals but it will be listed on stock exchange and so one can exit from there if require. The fund will be managed by a team of three Fund managers from AMC investment team.

Expected Performance

Since debt securities will be held till maturity one can expect a stable returns from this part of the portfolio primarily aiming for capital preservation. But it’s the equity exposure which will make fund volatile and enhances the risk too. However, being a closed ended fund the redemption pressure will not be on the fund manager and so the long term view is expected.

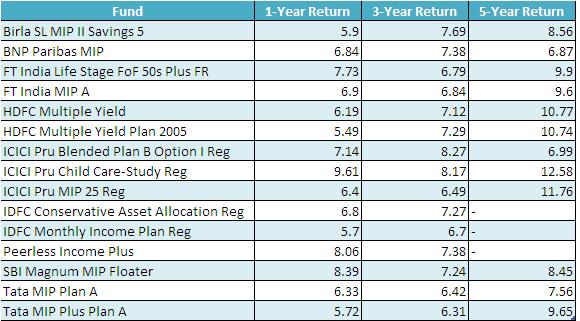

Hybrid funds category mainly comprise of MIPs, Multiple Yield Funds and Children’s Funds where even ICICI Prudential has various schemes. Most of the good performance of the category have come from open ended funds since it gives more flexibility to fund managers to manage the volatile markets.

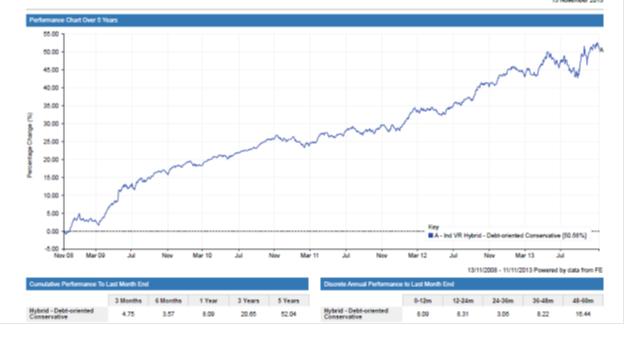

Performance Chart of Hybrid: Debt Oriented Conservative Category (%) as on 14th Nov 2013

Source : Valueresearch

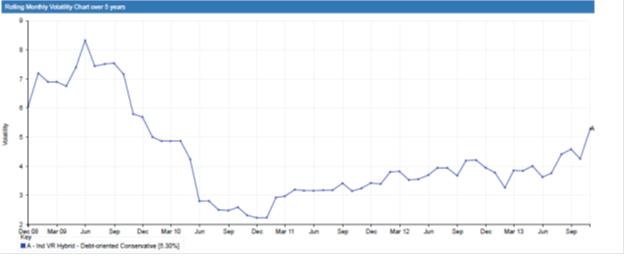

Volatility

The volatility will primarily arise from equity exposure but will be lower than open ended funds.

Fund Managers

ICICI Prudential Mutual Fund has now team of fund managers for all its funds and so this too will be managed by three fund managers- Mr.Aditya Pagaria, Mr. Atul Patel, and Mr.Rajat Chandak. None have a very long track record with AMC except Mr. Chandak and so the performance will be watched keenly with this new team management.

Points to Ponder

There are certain factors which one has to take into consideration with this fund-

- Taxability– Being a debt oriented fund the gains, are fully taxable. One will have to pay long term capital gains tax on the returns received from the fund.

- Liquidity– Being a closed ended fund there is no premature withdrawal but one can exit holdings at stock exchange where they are listed. However, the liquidity at exchange is quite low and so even if you get an opportunity you might have to sell it at a discount to NAV.

Should You Invest

The fund is considered to be suitable to investors who are looking at preserving capital with a decent exposure to equities for higher risk adjusted returns. The benefit of the funds argued is that there is no short term selling involves which add to the stability. But the excess returns depend on the equity exposure which can vary from 0-25%. If this underperforms in three years period then you end up not earning much since it’s a closed ended fund with fixed maturity and very low liquidity. Add to the taxability, you might just match inflation or even earn lower. An open ended MIPs with same equity exposure will be more considerable as you can always exit if it is not living up to your expectation which makes the NFO good to avoid.

What you think about the product? Share your views..

Post Disclaimer

IMPORTANT DISCLAIMER!

This and All the other Articles/Videos on this blog are for general Information and educational purposes and not to be taken as an Investment Advice. Any Action taken by Readers on their Personal finances after reading our articles or listening to our videos will be purely at his/her own risk, with no responsibility on the Writer and the Investment Adviser. Registration Granted by SEBI, membership of BASL and Certification from National Institute of Securities Markets (NISM) in no way guarantee performance of the intermediary or provide any assurance of returns to investors.