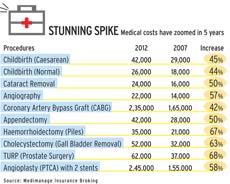

Heart Attack is an illness which is not restricted to old age any more. The stressful life style and unhealthy habits is increasing its probability even at younger age. The more worry some for any family with a heart patient is the rising cost of treatment. A CABG or Bypass surgery, as we all know it, cost today almost more than Rs 2 lakh. A recent report on healthcare calculated that this cost has increased by almost 42% in last five years. One can estimate what it will be in next five years if the rise happens at this rate.

And do not forget the regular medication and the precautions one has to take for survival if suffered a heart attack.Considering all these factors a health insurance for such illnesses becomes a necessity today.

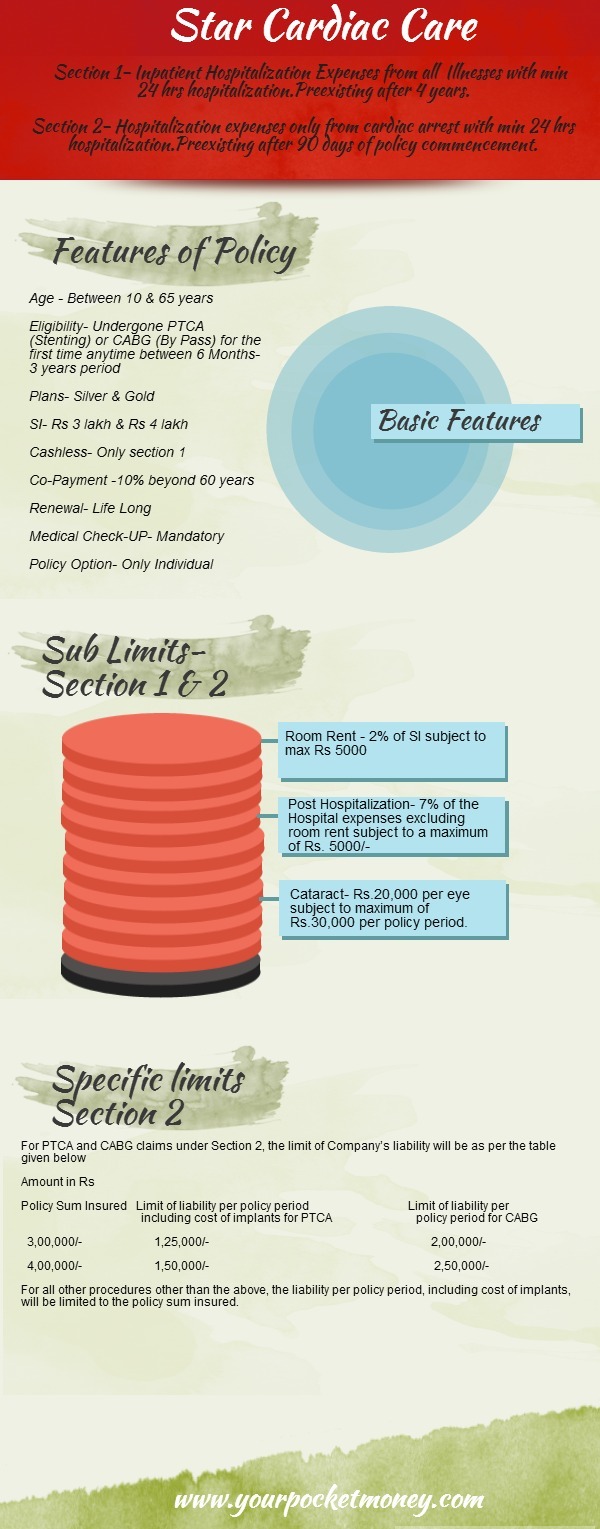

Although the hospitalization cost in cardiac attack is covered in basic health plans and Critical Illness insurance , there was no recourse for individuals who are already suffering from it. Now, Star Health Insurance company have introduced Star Cardiac Care Insurance Policy specifically for heart related problems.

Lets see what this policy is giving to the policyholders:

What it cost You?

Star Health is known for lower premiums due to higher sublimts. In this product the premiums are same for a very large age group. A younger age individual will find these on higher side as compared to old age.

Should You Buy?

Till now there was no option for heart patients to cover their future contingencies. All critical illness policies and basic health plans covers only when the first heart attack occurs but up to the cost of hospitalization. All preexisting illnesses are covered in these plans from 2-4th year onwards. But this policy covers preexisting illness of cardiac ailments from 91st day itself. However, there are specific limitations as illustrated above which will restrict the claim one can make.

The cost is the major consideration. It surely is on the higher side when you compare it with any basic health plans.If you have one then adding it may not be affordable. But, for any heart patients, covering heart ailments is a major concern especially for higher age group and this is the only option today. It then becomes a considerable option.

Specific policies like these will become a trend now as many companies want to move ahead of basic products.The healthcare cost are increasing and any health policy will be beneficial only when it can capture this increase without increasing the cost for buyers. Before you consider buying any health policy, read the policy wordings to know what you can claim and what you cannot.

Post Disclaimer

IMPORTANT DISCLAIMER!

This and All the other Articles/Videos on this blog are for general Information and educational purposes and not to be taken as an Investment Advice. Any Action taken by Readers on their Personal finances after reading our articles or listening to our videos will be purely at his/her own risk, with no responsibility on the Writer and the Investment Adviser. Registration Granted by SEBI, membership of BASL and Certification from National Institute of Securities Markets (NISM) in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

I paid them premium on time for 3 years for a floater policy of cover Rs. 5 lacs. My wife got admitted to Mission Hospital in Durgapur on 5th May’15 for chest infection. My wife got discharged on 8th May with a total bill of Rs. 20, 068/-.

To my surprise, I get a call from hospital stating that my insurance claim has been rejected. The reason is non-disclosure of “breast surgery” in the year 2003. The fact is my wife had undergone an “operation” to remove an external lump and was discharged from the hospital within 2 hours of being admitted. The word “operation” is very ambiguous. Even if we have a small “funsi” in our leg, the doctor uses the terminology “operation” for the removal of the same. Does that mean we would consider that as a medical situation that needs to be declared while buying an insurance policy 10 years later.

I am sorry that I didn’t declare that my wife suffered from cold in 1987 and she had to take a cold medicine for 2 days. She also suffered from fever in 1984 for which she had to take paracetamol. Are these the kind of declarations Star Health is expecting from its customers.

This is ridiculous since it has also been confirmed by the doctor treating my wife that the current chest congestion has nothing to do with the “funsi” operation she had 12 years back. This is just an “alibi” by Star Health to reject claims from customers.

I am an victim of this fraud being run by Star Health and I request all others to make sure that you do not buy insurance from them or if you already have a policy from them, get it transferred to a company that does not consider cold, fever and funsi which you have had 20 years back as a medical condition that you have to declare.

I will take this matter to court and will make sure that fraud companies like Start Health stop cheating innocent customers.

Chandra Shekhar Singh,

In general you should be disclosing all health related issue especially where there has been any kind of ” Surgery”. Whether its big or small issue is left to the company underwriters to decide. I have personally experienced cases where even 15 year old surgery has been taken in consideration and specific clause has been added in the health insurance policy.

So difficult to comment on your situation.