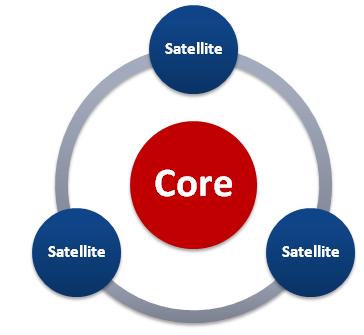

A core and satellite is a time tested technique for designing an investment portfolio for meeting your objectives. The approach is based on selecting different investment avenues catering to long term and short term requirements. By using this strategy one can bring discipline to the investments along with a roadmap for reaching the financial goals. However, following this strategy requires a bit of discipline and understanding the asset classes you are expecting to own. If your awareness on these is low you will find it difficult to create an ideal asset allocation which matches your requirement.

Here is what comprises a core & satellite strategy and how you can design your investment portfolio through this technique using mutual funds schemes:

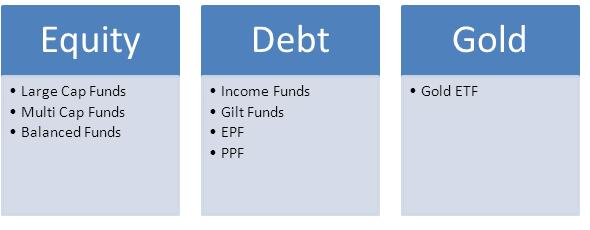

1. Core – The core in your portfolio generally comprises passive long term investments which are also the foundation of your investment portfolio. The money is diversified among different asset classes to ensure the objective of reaching your goals do not get jeopardized by the short term volatility and you earn steady and stable returns. Generally the core of your portfolio will be 70-90% and is created with a mix of equity and debt. The proportion of these two asset classes is decided based on your goal horizon and risk tolerance. So you can be high on equities or debt considering the above two factors. If you are investing through mutual funds then ideally the core should be invested in passive fund such as index funds. But in India the active funds provides a much better choice and so the core portfolio can be created with equity oriented funds from large cap, multi cap and balanced funds category. Debt investments will comprise of debt mutual funds schemes like long term Gilt & Income funds along with long term effective investment avenues such as EPF & PPF which will diversify the risk. Investment in gold can be included but wiser to restrict the exposure. Such a core portfolio ensures the safety and liquidity in your investments along with stable returns which can meet your long term financial goals.

The Core of Your Portfolio

2. Satellite– The satellite portfolio is that portion which helps in generating higher risk adjusted returns. This will contain generally riskier asset classes or MF schemes which will require close monitoring to grab the market opportunities. Mid and Small Cap funds or Sector Funds will form the satellite portfolio. Since it is built on the higher risk category, it is wiser to limit the satellite portfolio to 10-20%.

How to Manage the Core-Satellite Portfolio?

Once you have created your investment portfolio based on this strategy, the management of the same is more important. The core portfolio is for long term financial goals and the long term investment helps in reducing your transaction cost and incurring less tax liability. So you should not be liquidating this portfolio even if need arises. On other hand satellite portfolio is one where you might have to monitor it closely and devise a strategy to capture the expected returns although it may lead to higher cost and tax liability. But the objective is to reduce the impact through higher returns.

Who Should Adopt this Approach?

The core and satellite approach is a very effective strategy but may not suit first time investor. For them starting with just a core portfolio is much more beneficial. Once they gain experience, the satellite portion can be added. Also, if you are not well versed with asset classes, taking the help of advisor will be a more wiser approach.

Selecting a right allocation of assets is a key element in your financial planning. The core & satellite approach helps in meeting this objective. But do analyze your goals and risk appetite to identify the core portfolio since it will lay the foundation of your future well-being.

Post Disclaimer

IMPORTANT DISCLAIMER!

This and All the other Articles/Videos on this blog are for general Information and educational purposes and not to be taken as an Investment Advice. Any Action taken by Readers on their Personal finances after reading our articles or listening to our videos will be purely at his/her own risk, with no responsibility on the Writer and the Investment Adviser. Registration Granted by SEBI, membership of BASL and Certification from National Institute of Securities Markets (NISM) in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

One thought on “The Core & Satellite Approach for Asset Allocation”

Comments are closed.