Sec 54 provides relief from the tax on long term capital gains earned from residential property while Sec 54F covers assets other than this. However, there are certain rules which the assesse has to remember to claim benefits under these sections.Take the case of Rajeev who has invested in a land three years ago. He was amazed to see the appreciation of his investment. Without wasting time he sold the asset fetching handsome returns and bought another land which he expects to deliver him similar, if not more. But the rude shock came to him when he was denied the tax benefit on his gains and has to pay a hefty amount to income tax. The reason was misunderstanding of Sec 54F under which he was claiming the tax exemption.

Here I have discussed some of the rules under the two sections – 54 & 54F where an investor gaining from selling of property or other assets can claim tax exemption.

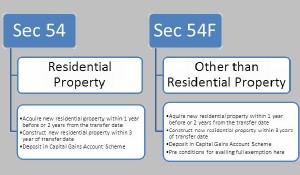

Sec 54

This is the section for availing tax benefit on long term capital gains arising from a residential property. Under this section if a residential house is sold after three year of purchase then one can avail tax exemptions on the gains by investing them in following options-

- A new residential property either bought within two years or constructed within three years from date of transfer of existing property. In case of buying a new property, the exemption is available even if it is bought within one year before the date of transfer.

- There might be a situation when you would not have decided on a new property but do not want to lock in the money in the bonds. In such instances, the money has to be deposited in a Capital Gains Account Scheme. This is a fixed deposit scheme specifically for long term capital gains earned from properties. The money can be kept there till three years, which is the threshold period for availing tax exemption. Till then you will be required to include the proof of deposit every year while filing your income tax return then only the tax exemption is available.

- The entire capital gains will be exempted where the amount of investment in new property or bonds is equal or greater than the capital gains earned.

One of the larger benefit of Section 54 is that one can hold n number of properties as on the date of transfer and still claim exemption on the gains.

Sec 54F

This section is available to all those assets other than residential houses. So for claiming long term capital gains arising from selling of land, this section is utilized. Here one can claim relief on the tax liability on capital gains but with following conditions:

- The options for claiming exemption are the same as under sec 54 .

- The amount of exemption available is derived as

Amount of investment*Capital Gains/Net Consideration

- One of the primary conditions which differentiate this section from Sec 54 is that the assesse can hold only one property other than the new residential property on the date of transfer. Even after purchase of the new property, no new property can be bought for three years else the capital gains become taxable.

- Thus, if one has made gains form a land then the exemption can be availed under Section 54F provided the conditions laid in the section are fulfilled.

- Unlike Sec 54, here the entire capital gains are exempted when the amount of investment is equal or greater than the net consideration else the proportionate exemption is allowed.

In both Sec 54 & Sec 54F, the exempted property cannot be sold within three years of acquisition else the taxability on gains will arise with respective section clauses. Both these sections are available to property investors for claiming long term capital gains tax exemptions. Apart from these, Capital Gains bonds under Sec 54EC are also available for claiming exemption of tax on long term capital gains earned from long term assets. But it’s wiser to take the help of an appropriate professional to utilize any of the sections illustrated here so that you do not face any disappointment later.

Post Disclaimer

IMPORTANT DISCLAIMER!

This and All the other Articles/Videos on this blog are for general Information and educational purposes and not to be taken as an Investment Advice. Any Action taken by Readers on their Personal finances after reading our articles or listening to our videos will be purely at his/her own risk, with no responsibility on the Writer and the Investment Adviser. Registration Granted by SEBI, membership of BASL and Certification from National Institute of Securities Markets (NISM) in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

Q1: Is Section 54F applicable for long term capital gain, earned by trading stocks outside India?

Q2: Can you please throw more light on difference between residential property and residential house? Section 54 taslk about residential house and here we are talking about residential property. Aren’t both different?

By definition Residential property would include residential plot, flat, independent house. Residential House will include only flat and independent house not the residential plot.

Thanking you in advance for your clarification.

Hi Arif,

1. As far as i know, long term capital gains earned on foreign equities do not fall under any tax exemption and one has to pay 20.6% LTCG tax on it.You can only adjust them with long term capital losses.Still you should get it confirmed with a CA as it comes under the global income earned by any resident which is taxed differently then domestic income.

2. A residential property here means any property which is used for residence which include a flat or an independent house but will not include a plot as it is a piece of land.

Sec 54 is applicable only to residential houses and sec 54F applies to other then residential houses which includes a plot. So when we are talking about residential property under sec 54 or for buying or constructing its a house.

Dear Mr Solanki,

Ownwership of more than one house plays a spoilsport in claiming exemption. In that case isn’t it wise to avoid joint ownership ex: husband and wife owning a house, where by they both own ‘a’ house in IT eyes.

2)In the new DTDC regime I heard this section is amended to exempt 54 and 54f exemptions can be claimed only if one do not own any residential units. kindly throw some light on this ?

Dear Mr.Thomas,

1. Yes if the house is in joint ownership then it will be counted as first house for both. However, owning more than one residential house is not a condition if the gains are earned from residential house i.e. under sec54. It is only when you earn long term gains other then residential houses this condition is imposed. Also, to own house individually or in joint, its a decision which most of the times rest on your financial situation.

2. DTC is yet to be implemented and it is going through many changes. Its difficult to say what will come in. There might be amendments in these Sections but not sure to what extent they will get implemented.

Dear Mr. Jitendra P.S Solanki,

Recently i came across a write up which has turned IT sec 54, LTCG exemption of residential property on its head. In fact it turned me on my head.

A ridiculous aspect was put that 54 LTCG can EVEN BE INVESTED IN SME units plant & machinery subject to 51% holding AS FER FY 13!??

Another came across re 54 LTCG — PUBLISHED in Business Standard, Mumbai, May 2,2011 by Mr.Sandeep Shanbhag which reads as under — quote

“CGAS does not allow any withdrawals, except for the specified purpose (of buying the house), even of interest. More, the investor is required to pay tax on this interest (to which he has no access) on an accrual basis out of his other income.

Even if the sale is effected in, say, the first month of the financial year (say, April 2011), the taxpayer may deposit the amount in CGAS on the last date for filing returns. In other words, he can freely utilise this money for 15 months (April 2011 to July 2012) as he likes”. — unquote

Are they not misleading on LTCG compliance? One on LTCG investment second completely disregarding 6 months, CGAS, either from sale date or ITR filing date, whichever is earlier.

Further no one has taken up 1% TDS issue, even ICAI is silent on it.

What if LTCG claim [say CGAS or bonds] short by 1% said TDS, no provision to remedy it. Assume the assesses have no income to file except LTCG claim returns. [Yes, 26AS credit even if not reflected in IT / not paid by the deductee / short paid, assesse can claim the same in ITR, but no such provision for 26QB & 16B furnishing.]

Solicit your valued comments.

Regards,

P.S – i’ll be writing to Business Standard re May 2011, aspects published.

Mr.Jitendra P.S Solanki,

Corrigendum :

In respect to my earlier post – pl read ‘as PER FY 13, not as ‘FER’.

Secondly, Business Standard quoted date is May 22, 2011 not May 2.

Kindly excuse the inadvertent typos.

Regards,

Dear Mr. Vinay,

1. In budget 2012 there was a proposal by Finance Minister Mr. Pranab Mukherjee for exempting capital gains tax on sale of a residential property, if the sale consideration is used for subscription in equity of a manufacturing SME company for purchase of new plant and machinery. I am not aware of its implementation and will have to look into it.

2. With regard to CGAS scheme, the income tax provision says you need to deposit the amount before due date of filing of the income tax return for that respective year which is 31st July and so the benefit of 15 months arises for any property sold in April. Also, there are two options-savings account and Fds here which work similar to your general account. And yes withdrawals are permitted only for the specified purpose only i.e. buying or constructing a new house. Infact some banks do not issue a cheque book for this account.

I hope this clarifies your doubt.

Respected sir

pls let me know what are the SPECIAL CONTIONS disallow benefit under

section 54 , long term capital gain comes from own purchase house property on my and my wife,s name (co owner)

and new property-house purchased in both name with in specified time limit and gain amount invested as per law and index calculation

Dear Mr. P.S Solanki,

Ref to your above answer & fwd to me the said caption provisions clause[s] of Finance Bill [proposed] 2012, thereafter passed.

If you so state & claim why was it tracked off?

As regards your point No2, answered in reply to me – why don’t you base it with highlight of IT secs 54, 54EC, 54F provisions & JUSTIFY 15 months filling? Get LTCG? Will you? Can you?

More importantly my aspect was 1% TDS! What if the seller is short of 1% to fulfill LTCG? The IT refund can come months later.

Can the seller not take 1% credit against 16B [with 26QB photocopy] – LTCG?

Solicit your comments!

Regards,

Dear Mr. Joshi,

One of the primary condition for exemption is that the exempted property/new property purchased cannot be sold within three years of acquisition else the taxability on gains will arise with respective section clauses. This means you need to hold the new property for at least three years period.

Dear Mr. Vinay,

The proposal in the budget for the said provision was under new section sec 54GB:

Relief from capital gains tax on sale of residential

property, if sale consideration is used for subscription to

equity of a manufacturing SME for purchase of new plant

and machinery.

You can read the details of relevant section here:

http://www.taxmann.com/taxmannflashes/BUD12-64e.htm

The inclusion of sec 54GB happened in the income tax act via this circular of CBDT-

http://law.incometaxindia.gov.in/DIT/File_opener.aspx?page=NOTF&schT=&csId=036bba0d-dc74-49c8-bc20-21450a97832c&NtN=44/2012&yr=ALL&sec=&sch=&title=Taxmann – Direct Tax Laws

So the benefit is there in income tax act now.

Thanks for raising this query which I hope is answered now…

Plot purchase Rs.10 lacs before three years and this plot sale on 36 lacs Profit Rs.26 Lacs. Now Rs.26 Lacs profit against i am purchase residence house. so applicable U/s.54?

Hi Mehul,

Any gains made from land is tax exempted under section 54F and not Sec 54.So you can claim the exemption as per sec 54F provisions.

I have booked a flat in oct 2010 which is under construction till today.

If I want to sell the right after 3 years and reinvest the money in other under construction flat, what will be tax liability to me.

Dear Mr. Kushawah,

As per Sec 54, you can invest the long term capital gains in an under construction residential property provided it gets completed within three years and you do not dispose it.

With regard to your capital gains, as per my knowledge, If you sell an under construction before possession then the long term capital gains are derived from the date of buying the right. If you have received possession before selling it, the LTCG will be calculated from the date of possession.

Do consult to a good CA for these calculations.

Dear Sir,

I am planning to sell one of my residential plots (land) that I have been owning for 5yrs. I own one house and couple of other plots (land) besides the property being sold. Can I use section 54F and claim exemption on long term gain by buying a flat (even if I own one house and 2 other pieces of land)?

If yes, can I sell each of other pieces of land and buy flat/house to get exemption under 54F?

If no, can I sell all 3 pieces of land and buy a single house (apart from the one house I own) using all the gains from all 3 plots and claim exemption using 54F?

Thanks in advance.

Regards,

Prasad

Dear Mr. Prasad,

For claiming benefit under section 54F the minimum condition has to be fulfilled. So if you hold more than one property other than the claimed asset then you will not be able to claim benefit under this section.

I have sold a land and wish to invest in a flat by investing the entire proceeeds. However, i wish to take it in the joint name of me and my father.My father has also sold a plot and wishes to invest the sale proceeds in the same flat. We plan to purchase this property in joint names. Can both of us claim exemption from LTCG? if so what is the procedure for filing returns?

Hello Sir.

I am planning to sell my land which I have purchased long back. Now I don’t have any flat or house on my name. So can I buy two houses or flats from the capital gains I earn? I mean will I get exemption on both the flats.

eg. I sold land for 40 lacs which I have purchased in 10 lacs. Now can I invest 30 lacs (deducting index value already) in two different flats and can claim exemption in both the flats?

Dear Mr. Krupa,

Since you earned gains from selling a Land, you will be able to claim benefit under Section 54 F.

As per my understanding and few cases upheld by different courts, you both should be able to claim tax exemption in the proportion of the contribution made.

However, i am not fully aware of its legalities and so you should consult a good CA who will be the right professional to guide you on your specific issue.

Hi Siddhanth,

If you have earned gains from selling land, then you will be able to claim exemption under sec 54F if you invest it in a residential house. Now with respect to your case of purchasing two houses, there have been different court cases and in one case the view of the courts in general was that “where two or more flats are acquired in the same apartment/complex and they are contiguous (adjoining) to each other and used as single residential unit, the exemption can be allowed for the cost of all those flats. However, where the flats are situated in different locations, then the exemption will be allowed only for one of the flats at the option of the assessee.”

So in my view, if you purchase two houses in different locations, exemptions will not be allowed on both the houses.

Hello Jitendra

I have sold a plot which also has a house on it. The proceeds are to be invested in a flat. I own 2 house properties as of now of which one is fully constructed and occupied. The other property is registered but is under construction at the time of the sale of the plot. Will Sec 54 F exemption be still applicable

Mahesh

Hi Mahesh,

As per Sec 54 provision you should not have another residential house apart from the house you are claiming exemption, on the date of transfer of original assets. So in my view if you have 2 other properties, you will not be eligible for Sec54F Exemption.

However, do consult a good tax expert on resolving your query.

Hi , i am planning to sell my ancestral property amt 2.5 cr

Is it possible to purchase two properties in two different location using that amount and avail tax exemption

Dear Navdeep,

In my view, Under section 54, i.e. selling of residential properties, you do not have any limitation on buying new properties.The location is not important and you can buy in any city.

Dear Mr. P. S Solanki,

I differ with your view, academic an aspect, requires representation to IT [FinMn]

IT, Mumbai a/o had escalated to IT Appeal, an issue of 54 LTCG, wherein an assesses IT return claimed having purchased two adjoining flats, from two different persons, then combined. Appeal allowed it BUT no clarity as IT secs not expressly wording it.

When LTCG arises from ‘the’ property sold & invested capital gains in ‘the’ property – exempt to the extent of investment.

Point is a single property sold to buy a single property.

The courts have also not defined this & in my considered opinion it may not be advisable to buy two different properties at two different locations from LTCG arising out of sale of a single property.

I recollect the scrutiny of the English language & definite article used in the said sec as deliberated upon by the court to surmise it & to mean ‘the’ property. In short — LTCG arising from sale of ‘the’ property, invested in ‘the’ property is tax exempt to the extent of invest.

You are referring to with explicit wording – selling of ‘properties’ & buying of ‘properties’. Whereas the query was – sale of ‘a’ property not properties.

Hence request to reconsider your valued post.

Regards,

IT appeals allowed assesses contention.

Hi Navdeep,

My interpretation on this aspect may not be right. Kindly take the help of a Chartered Accountant and an Advocate also on this issue as it involves the deep understanding of the taxation laws and court cases.

Hi Vinay,

Yes, there have been many cases in court where the benefit has been given to assesse on purchase of property adjacent to each other only. I got reference to many such cases along with a reference to the following case-

In CIT v. Smt.K.G.Rukminiamma [2011] it was held that the expression ‘a residential house’ used in section 54 does not convey the intention of the Legislature to mean a single residential house as eligible for exemption. If that was the intention, the Legislature might very well have used the word ‘one’ instead of ‘a residential house’.

Not a tax expert or a lawyer so can’t go much in detail of these.

Do you ave any view on this?

Dear Mr. P. S Solanki,

Yes, my view is we have to put it up to CBDT & FinMin asap for the clarification.

Further two different locations is different from two adjoining different flats/properties.

No tax advocate or CA will vouch for LTCG investment at two different locations. Exemption assured.

I’m escalating this to an ICAI member & who can undertake the issue to bring in experts views on the topic. It’s assumed the seller is sole inheritor. [explicit stated.]

If joint inheritor the question will not arise.

Will revert asap on getting other views.

Regards,

Dear Vinay,

Thanks for all your efforts in answering queries on taxation on such issues.

Will be looking forward for the experts views from you on the above query.

Dear Mr. P. S Solanki,

I’m definitely on this issue, somehow you have left 1% deduction & shortfall to meet LTCG in investment. Apart, i’ll come to you after escalating it to ICAI, CBDT & Revenue has to clarify on this on priority.

Actually Mr. Navdeep’s post is incomplete – as it doesn’t state his share in property – assumed it to be 100%!

But in the event if it’s joint inheritance the aspect is well settled.

However surprisingly Mr. Navdeep is yet silent, he should understand that w/o real facts presented a forum advisory can’t give any comments.

Further it’s important to make a note that neither the forum or the inputs can be made liable for any damages claim whatsoever, notwithstanding anything contained in any other aspects.

It’s normal a forum tries to put in max inputs w/o any liability on it’s part. However if the forum is abused a criminal action can be initiated against the persons.

This entails complete facts required as to purchase of two separate properties at two different locations.

A single seller can’t invest LTCG in two different properties at two different locations. Buy 1st property, balance to be kept in CGA/c, after five yrs or as banks free it also after three yrs buy second property.

Absurd a solution it can be. The requirement unknown!

Regards,

Dear Mr. Vinay,

I agree with you. Forums like these are made for sharing maximum inputs so that people searching for information on their issues can seek clarity. Although it may not resolve it completely as there are many complexities involved in some of them especially taxation matters but surely it gives a direction as to where one should take further assistance from the respective experts.

You have been instrumental in providing such inputs which is highly appreciated. With respect to Mr. Navdeep query, i am sure he will be taking assistance from other experts which i too have personally suggested him.

Keep sharing your valuable inputs. 🙂

Dear Mr. Solanki,

Firstly, would like to congratulate you for the article and thank you for taking time in educating the clarifying doubts of many.

I’m sharing below my case and the queries I have regarding Capital Gain and Taxation for the same.

I own a plot of residential land since May 2008 where I have not done any construction since purchase. Also, I had booked an apartment in Oct 2009 that got registered with the builder in May 2011 but I’m yet to get possession of the same. I’ve also taken a loan from banks for both these properties.

On browsing through the internet, my understanding is that if I sell both the above properties, then Section 54F will be applicable as both my properties cannot be termed as residential properties.

Have the below queries right now:

1. In case I sell the apartment booked in Oct 2009, will the capital gain be short term or long term? (I’m asking this as the registration has happened only May 2011).

a. In case the answer to the above is short term, can I save tax using Section 54/54F?

2. I’m assuming that selling the plot of land bought in May 2008 will attract only long term capital gain. Please confirm my understanding.

3. For both these properties, I have not taken any income tax exemption for interest paid to the banks. Can I add the interest paid to the cost of purchase of the property while calculating capital gain?

4. What are the options for me to save tax through Section 54/54F?

5. Is there a limitation on the number of properties I can hold or claim tax rebate on for Section 54 or 54F?

Regards,

Vinit Soni

hi

I have an ancestral property in Mumbai which has a building with tenants. I and 4 others are the owners and there are a few tenants in the building. The building is for redevlopment wherein owners are getting a particular amount and a equal flat each. I am getting an additional commercial unit. In the old building i already own a commercial unit only. So my questions are as follows

1) Will i be taxed on cash part also? Bulider says conveyyance will be given to the new society after OC. We will no longer own the land or building.

2) Since i am getting a flat and commercial unit ,what will be my tax on that and will owning a commercial unit already in the old building help me in any way?

3) The other owners have flats in the old building and so will they benefit from owning them (Sec54)? The agreement says new flats are not in exchange of flats in old building as I don’t have any flat and am still getting one. .Hence is there no transfer of flats.

4) The other owners already have another flat besides the old building flat so will they avail Sec 54 benefits still?

Dear sir,

I sold my property sometime on Nov,2012 and the capital gain is Rs.20 lakhs.

I opened Capital gain account in Indian Bank( SB Capital gain account) for Rs.20 lakhs in the month of July,2013( before due date for filing IT for that assessment year ) with the intention of using this money in buying a property within 2 years and constructing a new house within 3 years in a plot earlier purchased.

I purchased our ancestral house for RS.3 lakhs in April,2013 and spent Rs.7 lakhs for renovation/repair and construction of this house.Totally,I have spent Rs.10 lakhs in this house and used Rs.10 lakhs from the capital gain account for this purpose.

Now I am left with Rs.10 lakhs in my capital gain account.

I would like to know the following from you side:

a) Can I invest balance Rs.10 lakhs now in Rural Electrifiaction Corpn Ltd- Tax Bond with benefits under section 54ED of IT act for 3 years to avail tax exemption?

b) If REC tax bond is not possible now, can I use balance Rs.10 lakhs in costruction of another new house within 3 years from the date of selling property.Some people are telling that I can invest only in one property.Please clarify.Awaiting your immediate reply.

Regards,

V.L.Natarajan

Dear Mr.Vinit,

Thanks for the appreciation. I am putting my views within the study i have done :

1. In a real estate transaction long term capital gains are calculated if you have hold the asset for at least three years.But there is a difference when its an underconstruction property. In such cases if you sell it within the construction period the long term is calculated from the date of booking your right to purchase i.e. the date of tripatriate agreement you enter with builder or an allotment letter is issued to you for getting a right to purchase a defined house.

(This is not the date of booking a flat in a property where the construction has yet to be started and so the house no. is yet to be identified). But once you are given the possession,i.e. when the house is finally yours, then the long term gains is calculated from the date of possession. (Kindly verify this by taking help of CA ). The date of registration thus have very less relevance. Hence, in your case you need to look at the date of getting into the agreement where the exact house was identified or letter of allotment was issued. If its three years and still underconstruction, then on selling it you get the benefit of long term capital gains. Else once you get the possession, the date of possession will be taken for the LTCG Calculations.

2. Short term capital gains cannot be saved under these two sections

3. Land you bought in May 2008 will attract LTCG if sold after three years

4. No, interest cannot be added as cost of purchase. You can claim the interest paid on loan bought for construction of house U/s 24B i.e. upto Rs 1.5 lakh. But for any repayment during underconstruction, the total interest can be claimed only after the construction is completed and that too in 5 equal installment for 5 years within the limit of Rs 1.5 lakh. You cannot claim benefit of loan taken for purchasing a land.

5. The list is highlighted in this article. you can buy another house or invest in Capital gains Bonds but do keep it in the Capital Gains Scheme Account of banks if you decide to invest later.

6. Yes, there is a limitation under section 54F where you can hold only one property other than the new residential property (On which you are claiming exemption) on the date of transfer. Even after three years of purchase of the new property, no new property can be bought else the capital gains become taxable.. There is no such restriction under section 54 .

I hope i have clarified your doubts. But do take the help of a qualified CA especially since you have a underconstruction property where the terms of calculating LTCG are different and i have stated my views on the basis of study I have done.

Hi PM,

Difficult for me to answer your questions as i am not a tax expert. I am stating my views on some of it but you will need a good tax expert to have your queries resolved:

1. Yes you will be taxed on the cash part also. This is how CG will eb calculated

“In normal cases, the member would be regarded as having given up his existing flat and got a new flat and certain money in exchange for the old flat. Since an exchange is regarded as a transfer, such a transaction would be regarded as giving rise to capital gains. For computing the capital gains, the estimated market value of the new flat received in exchange would be added to the monetary amount received by the member to determine the consideration received by the member for giving up his existing flat. From this consideration, assuming that the capital gains is long term in nature (the flat has been held for at least three years), the member would be entitled to a deduction of the indexed cost of acquisition of his old flat. In case the flat was acquired before 1 April 1981, he would be entitled to substitute the fair market value of the flat as of that date and compute indexation from that date.”

2. Yes on these gains sec 54 benefit can be availed.

For rest of queries i don’t have much awareness. My advise for you is to seek the help a good expert since there has been many litigations in such cases reagarding the nature of gains in cash transactions.

Dear Mr.Natrajan,

1. Buying two different properties at different locations may not be viable for claiming sec 54 benefit. There are clarifications to be sought on such cases but I believe you may not get the exemption. You can read the above discussions thread where Mr. Vinay has clarified on this issue.

2. If you are stating about REC-Tax Free Bond, then they do not fall under this section and as far as I am aware Sec 54ED was applicable to gains made from listed shares and mutual funds which was dropped in 2006 as gains from these became tax free.

In general time limit for investing in bonds is within 6 months of transfer date.Its only for buying a house or construction 2-3 years time period is available.

Dear sir,

I understand that if you avail the benefit of 54F, you can not buy another new House property with in 3 years after you availed the exemption . Does this apply to only purchase of another House or Land also? Thanks very much for your time.

Hi Anwar,

This will mostly be applicable to property which fall under tax exemption. Since you do not get any exemption on land it should not be there. Still confirm from a tax expert.

Dear Mr. Jitendra P.S Solanki,

Sec 54, sec 54F, importantly LTCG, certain recent judgement’s are highlighted hereunder.

http://www.jitendrapssolanki.com/wp-content/uploads/2014/01/Recent-Judgements.pdf

Regards,

Disclaimer : The above should not be construed as legal / tax advise OR for that matter as expert an opinion. [yes, certain respected CA input is there.]

Neither I’am nor Mr.Solanki / the site ‘yourpocketmoney.com’, is liable or answerable to any untoward transaction exercised by any individual relying on the post.

This post is only meant to disseminate certain information for guidance only. Regards,

In the several taxation cases arising over a decade now, the MoF, CBDT, ITAT should come with clear understanding of LTCG, 54/54F or 54D/EC. STCG/LTCG of securities – equity shares trading in listed scripts on recognised bourses is clear, primarily STT.

Regards,

sir,

i have sold a property during Nov 2013 and made the capital gain of rs. 43.50 lacs.

01. what will be the a) last date for making payment of capital gain tax to govt and b) capital gain tax amount.c) How and where to pay tax amount

02. Meanwhile, I have deposited the amount in nationalised bank with the intention of purchase of site from a housing society (who assured me to get it registered within 3 years and construct a house on that site within 3 years. If it materialized, can i apply to I.T. Dept for returning of so paid captial gain tax amount in future AY

pl advise in this regard.

regards

karigowda udupa

Dear Sir,

Whether sale of right to flat against allotment letter is same as sale of a registered flat? I’d booked a flat 3 years back and the buiilder has not yet given me the possession as it is still under construction. At this moment I am planning to sell the flat. So presently the flat is not registered in my name but the allotment letter is giving me a right to own this flat, which I am extinguishing in favour of the buyer in consideration of money. Now if i am selling the flat at this stage whether I will get exemption under section 54 or 54F, if I reinvest in another flat within the stipulated period?

Dear Karigowda,

It will be good if you take consultation of a CA in this matter.

Hi Gaurav,

As per my info if you sell the flat during construction period the long term capital gains will be calculated form the date of agreement with your builder i..e when you purchase the right. So you should be able to claim benefit under Sec 54 if three years have elapsed.

But do consult a CA also.

hi sir my ques is weather a new residential house (new asset) purchased to avail exemption of the long term capital gain u/s 54F can be let out in 3 years of its purchase. please tell me :-

a) can be it let out ?

b) can be it sold within 3 years of its purchase without losing the benefit of exemption is availed?

please reply as soon as posible sir …

Dear Sir,

We are two brothers.My father registered his property(land) on my name alone before his death. I sold this property for Rs 73 lakhs on 23.01.2014. I paid Rs 36.50 lac to my brother through cheque with Rs20 stamp paper receipt settlement.

How to get Tax exemption for this?

Pls clarify

Navjout,

One of the primary condition of availing LTCG tax exemption under Sec 54/54F is that the new house purchased should be held at least for three years. So you cannot sell it within this period.

However, you can let it out and earn rental income from the property.

Mathimaran,

Tax exemption on Long term Capital Gains can only be availed for some specified investments. There is no exemption for giving money to your relatives.

A ancestral property is being sold, it is in my fathers name, and he has already expired, so under dispute. Now selling the same and I need to know how to save tax on the same.

1) can I take the proceeds in my mothers name (Senior Citizen), and then distribute between brothers

2) Individual brothers directly take the share as a inherited amount, and what would be the tax liability

Regards

Dear Sir,

I have sold commercial land for which LTCG is 31.00 Lacs. I have two residential Plots (Land Only) in my name. Can i claim exemption u/s 54F by purchasing new residential flat ? If answer would differ if i purchase new flat in the joint name with my husband ?

Respected Sir,

Please suggest –

1. Re-investment of long term capital gain from an under construction builder flat to another under construction builder flat is exempt from Income Tax or it is neccesary to get it registered ?

2. Whether renovation cost on a registered flat (where re-invetment is done) can also be included in re-investment cost ?

Thanks

Hari,

1. Taking proceeds in mother name and then distributing among children’s does not exempt from capital gains tax.

2. The calculation of capital gains will be separately done by each of the brothers because each brother is assessed to income-tax separately,especially because he is a co-owner. The share you receive will treated as selling price if you do not buy or construct any other property. You can save capital gains tax by investing in Capital Gains Bonds or property.

Take help of a CA to calculate the exact amount of gains of each individual.

Mr. Hari,

As per the inadequate information provided by you, its assumed that your father died intestate. Secondly you’ve not stated that whether your mother was joint holder of the property & that the title passes on to your mother with 100% share & interest in the said property.

Who is the owner of the property under dispute? Important!

1] If the mother is rightful owner — you have no title in the said property – she is required to comply with LTCG not you as you have no title to the said property. [if so you have not defined it.]

2] Dispute you’ve not stated. Has bearing. If the mother wants to sell the property having rightful title, legally nothing can prevent her from selling as per her own wishes.

3] Individual brothers heir apparent to deceased fathers property but on death if the title has passed on to his wife – in this case your mother as being owner, yours & others inheritance rights ceases.

In the event your mother is not a singular owner, apart from resolving dispute, LTCG will not arise as of now, all will have to get the property transferred in their joint names with probate from the court & thereafter immediate sell, ancestral holding counted, LTCG as per individual share in the property.

Regards,

Disclaimer : The above should not be construed as legal / tax advise OR for that matter as expert an opinion.

sir, one have residential house property in joint name and taken loan for the same. he have sold non residential long term capital asset.

1. now he want to invest capital gain in new house property. whether he can take exemption of capital gain u/s 54F?

2. can he use sales consideration of above assets for repayment of loan on residential house property.

Sir,

I have sold the residential property and want to purchase another residential property in the name of my brother from the sale proceeds received from my sale.

Am I eligible to claim an exemption u/s.54?

Pooja,

Not very sure on this as the act speaks about purchasing new property. In my view it should be related to residential property since you avail exemption on the same. You should seek advise of a CA on this matter.

But in case it is not allowed then buying jointly with your husband won’t have any impact on the rule.

Vishal,

1. Primary condition for investing LTCG in a new underconstruction property is that the construction should gets completed within three years from the date of transfer of previous one. Now the new construction of house should be on your name and not on any other person. If these conditions are met you will get the exemption. On necessity of registration of property you should check with a tax expert.

2. Renovation cost will not be included in Re-investment cost if the source of funds is not LTCG.

Pratik,

If you invest the proceeds of old property in the name of your brother you won’t be able to avail the exemption. One of the primary condition for availing this benefit is that the the investment in the house property should be in the name of the person who is deriving Capital Gain.

My paternal grandfather owns a flat in Bhopal (MP) and a plot in Faridabad. He is building a three-storied house on the Faridabad plot with the intention of giving one floor to each of his three children, including my father. My father proposes to partly fund the construction of the Faridabad house by purchasing the Bhopal flat from my grandfather, with funds that he (my father) has already raised by selling a plot of land that he (my father) owned in Bhopal.

This is the plan (as of now two events have occurred — the Faridabad house is under construction and my father’s Bhopal plot has been sold).

Can you suggest the best way of structuring this transaction to minimize the tax liability / stamp duty (for e.g. should my father fund the Faridabad construction by purchasing the Bhopal flat, or would it be advisable for my grandfather to gift / Will that flat to him?).

Sir,

I have purchased a plot in 2007. In 2012 I have purchased a Flat by taking home loan. Now I am getting good price of the plot purchased in 2007. I am planing to sale the plot and with that money I can repay the home loan. If I do this then whether I have to pay any LTCG tax?

Please guide me.

P.Jakir

Exemption of LTCG is available when you utilized within one year before or 2 years after the date of transfer. So If you have bought a house on loan within one year from the date of selling your plot and you sell property to repay this loan, then you should be able to claim exemption. But if more than one year has elapsed since you bought the house the exemption for LTCG tax won’t be available.

Do consult a Tax Professional also for your specific query.

Dear Mr Solanki,

I am planning to sell my commercial showroom/shop.

And will be re-investing it in a residential property. Will there be an exemption from LTCG?

Regards

Gourav

Pooja,

1. One of the condition under section 54F is that you cant hold only one property other than the property you invest on the date of transfer of sold property. So i believe he should be able to get the exemption. Still take view of a good tax expert.

2. Exemption on repayment of loan can only be availed if the property was bought in the last one year of date of transfer. Not aware of how joint property is treated for exemption.

Hi Ankit,

If any immovable property is received through Will then there is no cost involved like stamp duty or tax. But a Will is executed only on Death. Gifting the property through a gift deed may not have tax implication but your father will still have to bear the stamp duty tax since there will be transfer.

You should take the help of a tax expert for your situation.

Hi Gaurav,

LTCG on assets other than Residential house can be claimed under section 54F.

Greetings!

We are NRIs settled in the US. We now wish to sell off our home in India and would like to invest the entire amount in buying a home in the US. This will be our first home there. Is it possible to remit the entire proceeds which would amount to about $130,000 and what are the taxes or other such expense we may incur.

Many thanks,

Thomas

Dear Sir,

Property in name of my grandfather has been inherited by me and all other heirs to property have surrendered their rights in favor of me. The property was purchased my my grand father way back in 1952 kindly throw some light on LTCG on it.

vineet

Thomas,

A far as I am aware, for NRIs-

If the property was purchased through forex then repatriation of sale proceeds is permitted to the extent of amount paid for acquisition of property in forex. The balance amount, if any, needs to be credited to NRO account and can be remitted under US$ one million facility per calender year, after paying the required taxes from sale proceeds.

However, if the property was received through inheritance or settlement or purchased in Indian Rupees, then it will fall under US$ one million facility from NRO account per calender year, after paying required taxes from sale proceeds. You can now transfer these funds directly from NRO to NRE account also, within this ceiling.

Do note that these are my views. You should consult a good tax expert for a detailed clarification.

Dear Mr. Jitendra P.S Solanki,

In case of Ms.Nancy, TRC will also be required apart from other

holding details.

Buyer will be be required to deduct 1% of agreement value & deposit the same with IT in his PAN. Hence the question arises of claiming 1%. Irrespective of TRC 1% deduction is mandatory.

Expect Ms.Nancy takes note of this.

Regards,

Thanks for the input, Mr Joshi

Mr Solanki,

As mentioned above , I am selling a commercial property.

In order to receive a tax benefit , should I re-invest in a commercial property or a residential property.

Presently , I am holding one residential premises.

Regards

Gourav

Gaurav,

You do not get any exemption by investing in a commercial property. It has to be invested in a residential property or other options like Capital Gains Bonds.

Vineet,

At present, there is no tax on inheritance in India.But when you sell the inherited properties, you would be liable to pay income-tax on the gains earned by you on the sale.

Thank You Solankji

Thank You Solankiji

Hi,

By August 2013 my father sold the inherited property and with the capital gains we just did a fixed deposit on my father and mother’s name what i heard from section 54 i can buy a residential house within 2 years so i need to worry anything about Mar 2014 IT return ? or else i can just buy the house by August 2015 do the IT return on Mar 2016 .

Thanks

Kiran

Kiran,

The rule says that if you are not utilizing capital gains immediately then you need to deposit it in Capital Gains Account Scheme to exempt it from tax. This has to done before the deadline for filing the return .The deposited money can be used only to buy or construct a residential house within the prescribed time frame. If you fail to do so it will lead to taxation of the unutilized amount as long-term capital gain after three years of the sale of the first property..

So if i decided to buy a plot and construct the house. Say after buying a plot if i left with X lakhs which i intended to construct i need to put into CAGS ?

Thanks

Kiran

You cannot buy a plot with Long Term Capital Gains. There is no exemption allowed on it. The exemption is only on buying or construction of the residential house. Yes, whatever LTCG remains unutilized, whether fully or partially, it has to be deposited only in CGS scheme of Nationalised Bank.

sorry not to mention i am buying the plot to construct a house

Thanks

Kiran

Dear sir,

in long term capital gain my qustion are as under

1, from date of sale of vecant plot how much time purchaging the ready house/flat and how much time for plot purchaging time and due date when compliting the construction work? time frame ?

2. if i purchage vacant plot within 2 year from sale of vacant land and then after constuction the house within 1.5 to 2 year is ok ?

Dear sir,

in long term capital gain my qustion are as under

1, from date of sale of vecant plot how much time purchaging the ready house/flat and how much time for plot purchaging time and due date when compliting the construction work? time frame ?

2. if i purchage vacant plot within 2 year from sale of vacant land and then after constuction the house within 1.5 to 2 year is ok ?OR AFTER TWO YEAR FROM SALE CONSTRUCTION IS NOT COMPLETADE OF SOME WORK IS REMANING WHAT CAN I DO ?? IN SHORT WHAT IS RULE OF WITHIN THREE YEAR ?

Dear Jitesh

For purchasing a ready built flat or house, it should be completed within two years from the date of sale. However, for purchase of plot and construction of house the time limit is three years from the date of sale. Plot can be bought within one year or two years but construction must be completed within three years. Some work may be incomplete, but the amount required to be invested for claiming exemption must have been utilised before the time limit of three years.

Thanks Mr. Adinarayana for answering the query.

Hi Kiran,

You can claim exemption if the plot is specifically for construction of house. Refer to the query below which has been answered well.

long term capital gain is 50lac under sec54f.residential flat is purchased for70lac out of which 30lac our contribution and40lac as bank loan.Kindly advise impact of capital gain tax exemption

Dear Mr Solanki,

I sold my apartment purchased at a cost of Rs 25 Lacs in 2010 for 30 lacs in 2014. I have since purchased a residential plot for rs 18 lacs within a month of the sale. Does the transaction qualify for any tax relief under Sec 54/54F? If not what would be my tax liability and any means to reduce it? Thanks a ton in anticipation.

Dear Mr. Gupta,

In general under sec 54f you have to invest the entire sale proceeds to get the capital gains exemptions for the full amount of gains. If not so, then you get the exemption in same proportion in which the cost of the new house bears to net sale consideration. The calculation is on the basis of formula used in the article.

However, since part of the funds you have utilized are borrowed, its difficult for me to answer your query. There is a Kerela High court rulings which have disallowed such exemption stating that “Although it is not necessary that the same sale proceeds of the capital assets shall be used to purchase the residential house, the equivalent funds (not borrowed money) should be available with the assessee to purchase the residential house.” But there are other cases where it has been interpreted differently. So it would be beneficial if you seek the help of CA who would be able to guide you appropriately.

Dear Mr. Michael,

First you need to asses the long term capital gains. You can refer my article to calculate your gains.

http://www.moneycontrol.com/news/mf-experts/understanding-long-termshort-term-capital-gains_715289.html

The Cost Inflation index for 2010-2011 and 2013-2014 are 711 and 939. If I take these figures then you are actually having capital loss as the cost of purchase will inflate to more than the selling price. So your tax liability will be nil in that case. But the actual calculation will be based on which financial year you purchased in 2010.

You can asses it by taking actual date of purchase and selling and the respective Cost Inflation index for the financial year.

Dear Mr Solanki,

Thank you for such a prompt reply. I have gone through your article as well. The possession of the flat was handed over in April 2010 and it was sold in Feb 2014. So the relative figures should be 2010-11 at 711 and 2013 -14 at 939. Would that be correct?

Dear Mr.Michael,

Yes that will be correct.

Section 54: Old Asset: Residential Property, New Asset: Residential Property

Can we consider Vat & Service tax amount as cost of acquisition of new house property ?

We are four sisters having a site of 4800 sq feet ( cost of purchase of site was Rs.320000, purchased on 10-12-2000 ) jointly in Bangalore. We gave the property to joint venture and in return of site we each got one flat in an apartment. (Market price of 4 flats now is 80 Lakhs)

We have made a partition deed and one flat has been in my name and it has been given to rent.

I do own 50% share in existing house where i reside from past 25 years.

Now my question is if I should pay the capital gains now or at the time i sell the flat.

Please help me to save capital gains.

Regards

Ramya

I sold my agricultural land.Out of the sale proceeds,I set aside a certain amount for purchase of a builders flat in Gurgaon,under provisions of Sec 54 F.I also opened a separate bank account under Sec 54F,with that set aside amount to pay for the installments for the said flat.Now this big time builder has defaulted w.r.t timely completion of the flat,as against the promised 3 years, he has still not handed over/completed the flat/tower even after 9 years from the booking date.During this period I have paid the builder the full amount,as set aside for Tax exemption under Sec 54F.My case has now come under the ITO’s scrutney and I am being asked as to why the possession letter has not been provided to them as yet,well over the 3 years specified timeframe.What is my fault here?Can you tell me if the Govt./ IT authorities have given any grace in such cases.The builder quotes the international recession as a reason, late FDI permission by the Govt etc.Looking forward to a quick response from your end.

Mahesh,

In general Service Tax and Vat should be included in the cost of acquisition of old property when you are calculating your capital gains.However, I am not too clear on the new property as it has been few years when Service Tax is implemented. Good to take help of a CA.

Suman,

I am not a tax expert so will not be able to advise on your case.But I was going through few court cases and below is a recent one where High Court and Tax Tribunal took a decision. The case runs similarity to your situation and may answer your query-

http://www.jitendrapssolanki.com/wp-content/uploads/2014/03/Sec-54-F-recent-case.pdf

Hope this reference helps.

Take the help of a tax or legal expert who will be able to advise you more appropriately to answer Income Tax Queries.

Ramya,

In general, gains arising from transfer, exchange or relinquishment of a capital asset are subject to capital gains tax. The date on which the sale/transfer takes place is when capital gain arises. So in my view your capital gains will arise the day you get the possession of new house. The amount of capital gains ill be as per what you have received in the replacement.

But there are more legalities involved in such transactions for deriving the capital gains. So do take assistance from a competent lawyer.

Dear Sir,

We are going to sell our ancestral house(we are just giving our possession rights as we aren’t the owner of the house).

1) How can we save the capital gains tax on the same?

2) The party is ready to give cheques to all the family members.so is there any use in taking so many cheques or should we take just 2 cheques (one for my Dad & other for my uncle)??

3) How will i come to know whether the 54EC Bonds are going to be applicable for 2014-15 as well?? Is it a compulsory thing to do for the government to come out with REC & NHAI bonds every year??

Thanks & Regards,

Chetan

Mr.Chetan,

Who is the owner of the said ancestral house? Property?

Are you a tenant?

Regards,

Dear Vinay,

The owner of the property has sold their rights to the developer. My family is staying there since nearly 100 yrs now. My great grandfather had built the house but as he fell short of money he took a loan from someone and inturn transferred the property to their name. We never paid any rent but we regularly paid the Gharpatti(Gram Panchayat Taxes) for the house.

So kindly help.

Regards,

Chetan

Sir,

Thanks for the reply. Here i am writing the detail of our property.

We had given our vacant site to joint venture on 21-october-2011 and I got one flat in an an apartment on 30-november-2012. (the site was purchased on 10-02-2000)

Can we claim capital gains exemption under section 54 and 54 F of Income tax.

Can the exemption also be claimed if the house is given for rent.

I have one home in which i am residing and i don’t have any other property in my name.

Please help regarding the matter.

Sir,

Thanks for the reply. Here i am writing the detail of our property.

We had given our vacant site to joint venture on 21-october-2011 and I got one flat in an an apartment on 30-november-2012. (the site was purchased on 10-02-2000)

Can we claim capital gains exemption under section 54 and 54 F of Income tax.

Can the exemption also be claimed if the house is given for rent.

I have one home in which i am residing and i don’t have any other property in my name.

Please help regarding the matter.

Sir,

You mention that the residential house purchased under section 54F can be rented out. Can you please clarify this against sub-section 1 (b) of section 54f which I am reproducing here:

[Provided that nothing contained in this sub-section shall apply where—

(b) the income from such residential house, other than the one residential house owned on the date of transfer of the original asset, is chargeable under the head “Income from house property”.]

Thank you.

Regards

Kartik

Mr.Chetan,

Noted with due diligence the aspects put up by you.

It’s apparent you are not the owner of the property.

For LTCG in which manner you’ll establish your compensation?

It’s advised by me you should consult your tax expert as certain legal intricacies are involved. Fine point is ‘developer party’, giving compensation – under which provisions? That should should be the aspect for LTCG! As per the agreement.

Regards,

Dear Vinay Sir,

Though we aren’t the owners of the house, we are having the control of the same since last 100 years. We are just selling our possession rights (as in case of a tenant) to the developer. If that doesn’t come under LTCG then what would the profit arising from the same be termed as????

The thing which i want to know is that whether the 54EC bonds do come every year?? I mean is it mandatory from the government side or whether it depends on whether REC & NHAI are in need of money??

If yes then by what date can i expect an advertisement for the bonds for 2014-15.

Regards,

Chetan

Kartik,

There are few conditions to be fulfilled for exemption under sec 54 F:-

(i) The assessee should be an individual or a Hindu Undivided Family (HUF).

(ii) The asset transferred should be any long-term capital asset but other than a residential house.

(iii) The assessee should have purchased, within one year before the date of transfer or two years after the date of transfer or constructed within three years after the date of transfer (or from the date of receipt of compensation in the case of compulsory acquisition), a residential house (hereinafter referred to as “new house”).

(iv) The assessee should not have sold or transferred the new house within three years of its purchase or construction.

(v) The assessee should not own on the date of transfer of the original asset more than one residential house (other than the new house). He should also not purchase within a period of one year after such date or construct within a period of three years after such date any residential house whose income is taxable under the head “Income from House property”(other than the new house).

(vi) The assessee also has the option of depositing this amount in Capital Gains Account Scheme as explained in section 54 above, before the due date of furnishing the Income-tax return.

So point no V should be the interpretation of the section you are mentioning. Still i haven’t come across any case where exemption is denied if property is let out. In my view giving property on rent is not a constraint for sec 54 or 54F exemption.

However, verify from a tax expert for arriving to any conclusion. My comments are within my understanding of these sections.

Hello Mr. Chetan,

My last post was explicit in the matter in every aspect.

Regards,

SIR,

MY QUESTION IS REGARDING LAND……

ONE OF MY CLIENT PURCHASED LAND AT RS. 6 LAC N SALE IT AFTER 3 YEARS AT RS. 2.43 CRORES.

NOW THE ASSESSEE INVEST THE FULL AMOUNT INTO ANOTHER LAND…

NOW THE PARTY DECIDE TO DEVELOP THE LAND BY PLOTTING ON IT IN PARTNERSHIP FIRM…

NOW WHAT IS THE TAX EFFECT >

SHOULD PARTY CLAIM EXEMPTION IN ANY SECTION FOR LONG TERM CAPITAL GAIN OR CAN CLAIM DEDUCTION OF THE OTHER LAND PURCHASED BY HIM ?

Rinkesh,

Firstly, you cannot avail long term capital gains tax exemption by investing in land. It has to be utilized only for a residential house. If you have bought land for construction of residential house and complete it within time you will be able to avail the exemption.

Second issue is the ownership. If your client was a complete owner of the previous property, then the capital gains taxation liability rest on him. In such instance the new house has to be in his ownership. In my view, he will not avail exemption if the new ownership is different from the previous.

Lastly, this is sec 54F benefit. A per rule you cannot own more than one house on which you are claiming exemption. Only if multiple houses are utilized or converted into a single unit the exemption will be applicable. However, this type of situation is debatable and you can refer to court rulings here:

http://www.jitendrapssolanki.com/wp-content/uploads/2014/01/Recent-Judgements.pdf

These are my views. For a detailed discussion you should consult a tax expert/lawyer who will be able to guide you on the legalities involved.

Dear Mr.Solanki,

I have 3 residential flats out of which 1 in my name only and the other 2 in joint names with my wife and son. I plan to sell the flat which is only in my name (Purchased in 1986). After selling the flat I wish to purchase a new residential flat of the same or more value.

I have the following queries:-

1) Will I be exempted from tax under Sec 54

2) Can I purchase a commercial property instead and still be eligible for exemption under Sec 54

3) Will I get a benefit of 1986 indexation in case I don’t be eligible for exemption under Sec 54

4) Can I rent out the flat which I purchase immediately and show rent in my income and pay tax on the same.

5) Can I gift the flat to my son since he has only 1 flat in joint names and then he sells the flat later in a month.

Thanking you in advance.

Dr.Jigar Gala

Dr.Jigar Gala

Dr. Jigar Gala,

You can sell the flat but to avail 54 you can’t invest it ‘into commercial property’. If you invest the entire sale value in resi. flat, need not bother of 54 at all. This concludes your first two queries.

There is no such thing as indexation of 1986, ’86 purchase value as per 2014 indexation you’re eligible under 54, LTCG investment, not otherwise.

As regards your pt. 4&5, yes you can rent out the flat, can gift the flat to the son, irrespective of the no. of flats he holds. He can sell it later month, it will attract STCG.

Regards,

Thank you very much for your comments. However my chartered accountant told me that it could be debatable since I have 2 flats and will be buying the third flat after selling the 3rd flat I already have, I will not fall under tax exemption as section 54 does not state exemption for more that one residential flat.

Please comment and advice.

However as per your comments and advice you feel that in case i sell one flat out of three and purchase a flat in one year time, I will not have to pay any long term capital gain tax?

Dear Mr Solanki

I sold my residential plot ;(on which we had made no construction) and was in joint name of my mother and myself; after 8+ years and am now purchasing a flat (in the same joint name) from the sale amount. Please clarify if I would be illegible for the Indexation benefit from the sale of the plot or would I have to invest the entire amount received from the sale of the plot towards purchase of the flat.

Dr.Jigar Gala,

Tax Exemption on The Long Term Capital Gains from Residential House falls under the preview of Section 54. Under this section, there is no restriction on number of properties you are holding on the date of transfer of the previous asset. The condition of not more than one residential property apart from the exempted house is under section 54F where LTCG from assets other than residential are included . So in my view you should be able to avail the exemption under sec 54 by investing the proceeds in a residential house.

You can consult other CAs for your benefit.

Dear sir ,

Please guide me in following matter.

Following are the facts of the case

1) land purchase in joint name in june 2011 (wives of both brother)

2) started construction of own house in may 2012 and expected to be completed in December 2014 or January 2015.

3) sale long term capital asset in march 2014.

My question is whether assessee can take the benefit of Section 54F of Capital gain.

Because

1) One of the condition of Section 54f is to complete the construction within 3 years after the transfer of long term capital asset takes place.

but in my case construction already started before 2 years and expecting to complete within 1 year after the transfer of long term capital asset takes place.

Please sir guide me

Regards

Abhishek

Saksham,

Long term capital gains earned from real estate is taxed at 20% with indexation benefit. There is no other choice here. Investing in other residential house is one of the options for availing the exemption of the tax liability which you have incurred.

Dear Mr Solanki

I do understand that I can claim exemption of the Tax by investing in another residential house but I have received a contrary opinion that since the sale of my residential property was a plot and not a built up house I would not be able to claim the indexation benefit but will have to invest the entire sum received from the sale of the plot in the new house. Please shed light on the same.

Saksham,

In real estate, residential or plot, long term capital gains tax is calculated at 20% with indexation benefit. There are assets where indexation of cost is not allowed such as bonds, debentures etc. But in case of a plot also you claim the indexed cost benefit for deriving the long term capital gains taxability.

The condition of investing the entire sale proceeds in new house is for availing the exemption of the tax under Sec54 in case of gains on assets other than residential house.But here also if you own more than one house on the date of transfer or purchase/construct within 2/3 year other than exempted house, then you will not be eligible for claiming tax exemption.

Hope this helps you in clarifying your situation.

Abhishek,

Exemption u/s 54F may be granted if the construction of house started before the sale of the said house property, provided you have proof of investing the whole amount in the construction of your house. In my view this relaxation is applicable only for within one year before sale of asset. Since you started construction two years before, you may not get the exemption.

However, this is my interpretation and you should take view of a good tax expert to clarify.

dear sir,

The commencement of construction appears to be of no consequence.

Its the completion of construction to be not before one year prior to date of sale of original asset from which cap-gain has taken place.

Pl check.

Samant,

Yes. The case of CIT v J.R. Subramanya Bhat (1985) 165 ITR (Karnataka), the court ruled that the construction can start before the transfer date but should be completed only after the selling of previous asset. The court observed that “It was immaterial when the construction commenced, the sole and important consideration as per the Section was that the construction should be completed within the specified period.”

Although the case pertains to sec 54, the interpretation should be for both the sections.

@Abhishek,

With reference to the case of CIT v J.R. Subramanya Bhat (1985) 165 ITR (Karnataka), the construction can start well before the date of selling your asset but should get completed after it. So as per the court ruling you should be able to get the exemption.

Still, take a view from a good tax expert.

Sir,

I have a vacant land with in city limits (possession since 2010) and a residential house outside city limits (inherited, original owner possession since 1993). I want to sell both of them and buy a residential flat out of the proceeds. I plan to put the money in CGS account till I finalize the new property. My questions are:

1. Should I open two different CGS accounts for depositing the proceeds as one falls under 54 and other under 54 F

2. Can I claim exemption from both the accounts for buying the flat?

Please note that I do not have any other residential house / property. In short, I’m consolidating the LTCG from both the properties to invest in a single residential unit. Is it permissible or is the exemption available only for LTCG from residential house?

Mr. V. Krishnan,

Your pt.1 – yes you’ll have to establish two different a/cs. [banks require the agreement to determine it, they will not establish it in the first place.]

Your pt.2 – combining 54 & 54F LTCG into one property certain aspects are there.

54F[d][ii] – how you’ll how you’ll comply? 54 clear an aspect.

It states that ‘that if the cost of new asset is less than the net consideration of the original asset [in this case YOUR LAND], so much of the capital gain as bears to whole of capital gain the same proportion as the cost of new asset bears to the net consideration, shall not be charged u/s 45.

However it is advised that you consult legal & tax expert. [there are certain possibilities.]

Regards,

Disclaimer : The above should not be construed as legal / tax advice OR for that matter as expert an opinion.

Dear Sir,

I’m holding one residential flat. And now I’m selling my commercial property and I want to avail benefit u/s 54F by purchasing another residential flat. Can I get the exemption u/s 54F?

Nishit,

Sec 54F rules states that you should not be owning any other residential house apart from the exempted one. In my view you would not be able to avail the exemption since you already owns a residential house.

If two residential properties are sold then can the sale proceeds of both be utilised for purchase of another property(one property)to avoid capital gains from both the properties.

Sir,

Can u give me the relevant case law on the following case

LTCG on 01/08/2011

Less: Deduction U/s 54B

and invested in capital gain account for the same

and not utilized the same till now

so i want to ask that same amount can be claim in 54F as deduction

Govindrajan,

Not sure on the clubbing aspect whether income tax allows it. However, there is a case of Rajesh Kashev Pillai where Income Tax Tribunal has taken a view that as per the rule of sec 54 there is No restrictions on the number of property sold to claim exemption but Only one property can be bought against each claim.

Take the assistance of a CA as your case requires a good understanding of the rule of this section.

Rachit,

As per section 54B of the Income Tax Act, 1961, in case the property sold was used for agricultural purposes only, for at least 2 years before the date of its sale, the long term capital gains arising from the same will have to be used for purchase of another agricultural land only within 2 years from the date of sale of original property in order to avail capital gains exemption on the same.

So in my view if it falls under Sec 54B you cannot claim exemption under Sec 54F. You can read about the case in Punjab and Haryana High Court in the case of CIT v. Gurnam Singh 327 ITR 278. The Income Tax Tribunal and High Court has allowed the exemption under sec 54B only on the fact that the gains are not utilized for buying other than agricultural land.

For more clarification, you can take help of a good CA.

I SOLD AG. LAND OF URBAN AREA AND PURCHASED RESIDENTIAL HOUSE OF PART AMOUNT AND INVESTED PART AMOUNT IN CAPITAL GAIN BOND WHETHER EXEMPTION WOULD BE AVAILABLE FOR BOTH SECTION U/S 54 EC AND 54 F

Hi,

Interest received on REC Capital Gain Bonds — Is taxable on receipt basis or accrual basis?

Thanks

My father in law expired 10 years ago.He had 3 sons including my husband who also expired 7 years back.We sold our 40 years old property inherited from my father in law.The amount was distributed amongst three of us.I don’t have any papers like old sale deed or new sale deed but that much I know that the new sale deed has our names mentioned i.e. me and both my elder brothers in law’s with pan card nos as sellers.Do I really need the photocopy of all the above mentioned papers for further query or use?As we are not really in good talking terms I feel hesitant asking for them.

My question is that, how do I have to take care of long term capital gain tax. Do I have to bother about my tax only? In the capital gain account do I have to keep the entire amount or only the calculated capital gain tax.

What if my brothers in law are not doing anything to save taxes.Should I be bothered about all this or go for capital gain exemption for me only. In the sale deed even the DD nos are also mentioned.

Early reply is really appreciated.

Pradeep,

The exemption for investment in residential property is available for Sec 54 & 54B which is for residential and other properties.

Any exemption on gains from agricultural land (Urban) is available under sec 54 B and as per its provision the gains has to be invested again in an agricultural land. In my view your exemption in residential property may not qualify.

However, urban agri land is a capital asset and so the exemptions must be available under Capital Gains Bonds. So you may be able to claim exemptions for this portion of your invested gain.

But these are my views and the income tax provisions need to be understand with reference to any past tribunal/court rulings, you should do seek the assistance from a qualified tax expert.

Our agricultural land was acquired by Government of India for Power Project and in turn my father received an amount of Rs.10 lacs. This land was purchased by my grandfather may be 60 to 70 years back.

What is the tax treatment for it ?

sir

i have a plot with a house which i got from a will from my mother after her death in nov 1989. now the property is in my name.The plot was purchased in 1955 for rs. 2500.A portion of it has gone to my sister.Now i want to demolish the house and sell a portion of the plot which may fetch me 1.6 crores.i have another house inthe same plot.Now if i sell a portion of the plot and build a house in another portion of the plot and with the remaining money can i buy residential plots and keep them for long time. What will be my comitmets for tax and on which account i have to deposit the sale proceedings till i spend within 3 years of sale of the plot

MY ANCENSTRAL PROPERTY 80000 SQ FT GIVEN FOR JV AND I HAVE RECIVED 90000 LAC AS A DEPOSIT .AND I WILL COME 60000 SQ FT SALEBLE CONSTRUCTED AREA AFTER FOUR YEAR KNOW HOW CAN CALCULATE MY LTCG, HOW CAN I INVEST MY MONEY FOR EXEMPTION U/S 54, 54F AND AFTER SELLING MY 60000 SQ FT CONSTRUCTED AREA HOW CAN CALCULATE MY TAX LIABILITIES, PLEASE SUGGEST ME IN MY FAMILLY FOUR PERSONE MOTHER, FATHER, BROTHER AND ME. PLEASE SUGGEST ME. I AM RESIDENT IN PUNE.

Chinu,

The tax liability in your ancestral property will arise on three of you in your respective share. So you will have to pay tax on your respective share and your brother in law on their share of gains. I don’t think you should be bothered about your brother in law tax liability as they own it.

Now or deriving your share of long term capital gains there is a defined process of taking the cost of purchase and then indexing it. You will have to calculate on the total property and then divide by 3 to get your share of gains. For this you might require property papers to know the exact date of purchase.

With respect to exemption on your gains you can use options available under sec 54 or 54f, as per property sold. If it was residential property then you need to invest only the gains.

Lastly, your brother-in-law gains should not be a concern for you.

All said, you should seek assistance of a lawyer and a CA to know the exact position about documents required and calculation of gains. I have given an opinion but cannot answer you on the legalities as it is beyond my expertise.

Mr.Nana Namdeo Tapkir,

You have finalized a JV for development of 7,400 sq.mtr [approx] with rights for sale of 5,500+ sq.mtr [approx] & YOU ARE GETTING DEPOSIT OF 900 CRORES – [90,000 lacs]!?

No details are stated & WHY DEVELOPER DEPOSITED 900 CRORES WITH YOU? FOR WHAT?

WHEN YOU FINALIZED THE DEAL OF 1K+CR – YOU HAD NO ADVISERS!?

YOU’RE SEEKING PORTAL SUGGESTIONS!?

This portal can definitely advise if you scan & send all documents to Mr.Jitendra P.S Solanki.

HNI, seeks portal suggestion!

Regards,

Mr.Jitendra P.S Solanki,

You have explained the aspects to Chinu.

I wish to add to your stmnt, 1% TDS will be there by the buyer.

It’s not clear the cheque/draft was recd by the first named in or by two brothers & consideration distributed [given to Chinu] or three separate payments by the buyer.

Irrespective for any step towards LTCG exemption, calculation, investment certified registered copies of purchase deed & sale deed must.

Regards,

Nana Tapkir,

As Mr. Vinay Joshi highlighted, the data given by you is huge and not having any adviser is a doubtful scenario.

Kindly elaborate your query or else correct the figures if typed wrongly.

Sanjiv,

In my view, Agricultural Land in rural areas (where it is used only for agriculture) is not treated as a capital assets and so they do not fall under preview of capital gains. Hence there is no capital gains taxation.

However, there are conditions laid down by IT on what can be defined as agricultural land, which you should verify from a CA.

Mr.Vinay,

Thanks for your valuable input.

K shehadri,